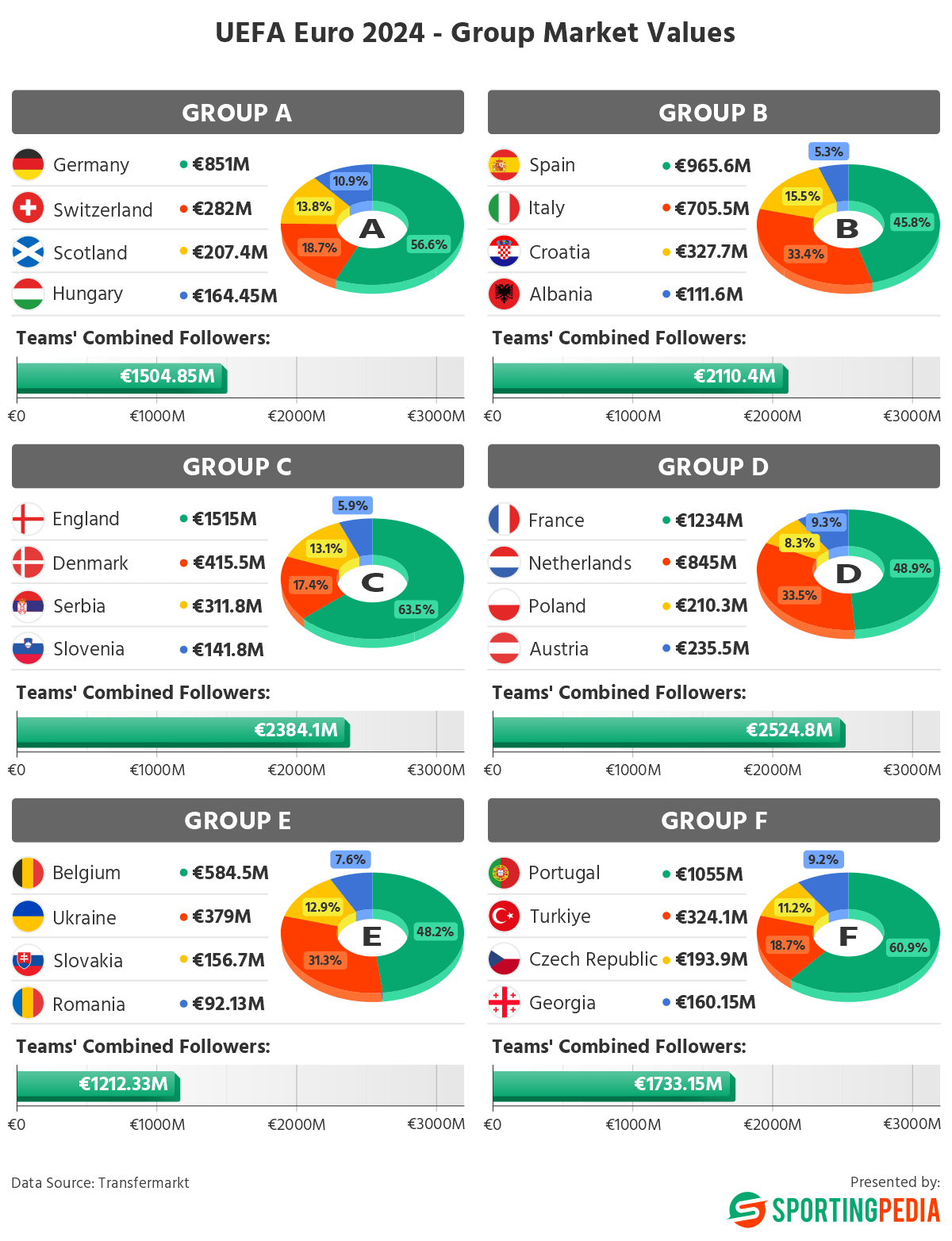

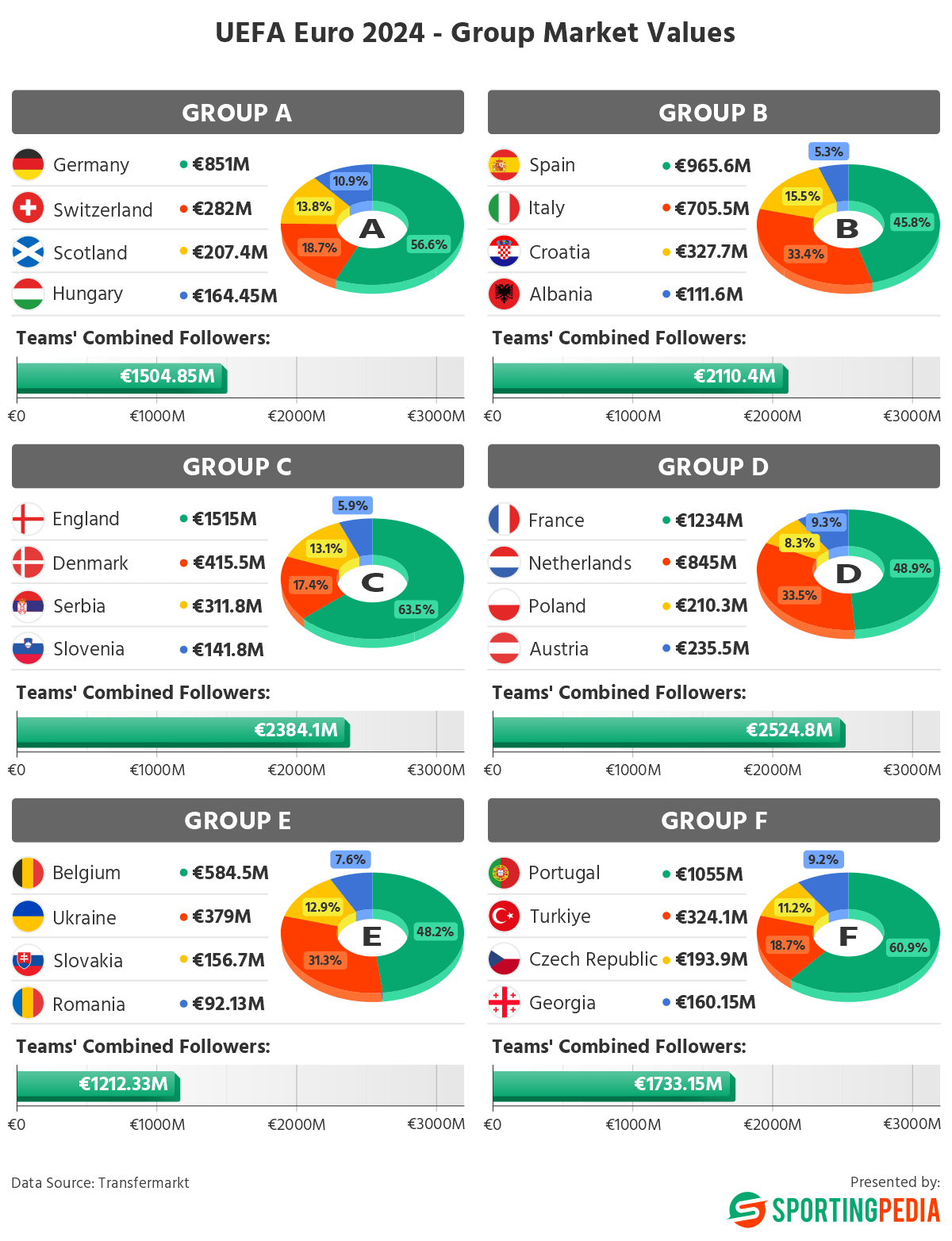

The 24 best national teams on the continent gather in Germany to determine who will inherit Italy as the next European champion. The opening match of Euro 2024 is in just three days’ time, with Germany and Scotland meeting on Friday. In this week’s Sportingpedia report, we examine the market values of each participating team and analyze their respective shares of the group’s total value. The objective was to assess how the teams within each group compare amongst each other in terms of their overall worth. We sought to identify the most significant disparities and pinpoint which groups exhibit the highest and lowest levels of competitiveness when it comes to market value. To accomplish this, we collected data on the current market values of all the participating teams and subsequently calculated the cumulative values for each group and plotted this data on a nice visual chart for comparison.

Key Takeaways:

- England, Portugal, and Germany are the three teams who hold over 50% share of their entire respective group’s valuation

- Albania’s value, representing 5.3% of Group B has the smallest share of the Group’s total valuation for any team at Euro 24

- Market Values for each group vary from €1.21 billion to €2.52 billion or a 208% margin

- England has the largest share of any group at 63.5% of Group C

- Groups A & E are the most balanced when it comes to team market values; Groups C & F are the most imbalanced

Most Valuable Groups – C & D

France, Netherlands, Poland, and Austria have formed the most valuable group at Euro 2024, reaching a combined estimate of just over €2.5 billion. France enjoys the lion’s share, representing 49% of that figure. The Netherlands also have a strong case to finish in one of the top 2 places in the group, as the Oranje’s valuation of €845 million gives them 33.5% of the entire group, while Austria and Poland are responsible for 9.3% and 8.3%, respectively.

The most expensive team in Germany – England, is part of the 2nd most valuable group. The Three Lions, worth over €1.5 billion, were drawn in Pot C, where they alone represent 63.5% of the total valuation of €2.38 billion. Denmark and Serbia have similar estimates, ranking 2nd and 3rd, while Slovenia’s worth of €141.8 million is enough for only 5.9% of the combined Group C value.

Middle Ground – Groups B & F

Group B boasts the likes of Spain, Italy, Croatia, and Albania. This is the group where the most expensive squad – Spain, has the smallest share of 45.8%, when compared to the other pots. The defending champion Italy has 33%, over two times more than Croatia’s 16%. Albania is the clear underdog in Group B, representing just 5.3% of the combined pot’s value.

In Group F, Portugal, led by Cristiano Ronaldo, accounts for 61% of the total estimate. It is one of the most competitive groups, as Turkiye, Czech Republic, and Georgia all have shares within 9% of each other.

Least Expensive Groups – A & E

The entire Group A, including the hosting nation Germany, along with Switzerland, Scotland, and Hungary, has a valuation of slightly over €1.5 billion, less than England’s alone. Germany’s estimate of €851 million gives them 57% of the group’s total. It is also the most balanced group, as the difference between the lowest valued team – Hungary, and the 2nd most expensive – Switzerland, stands at 7.8%.

Group E’s combined value is less than France’s alone. Belgium, Ukraine, Slovakia, and Romania have formed the least valuable group at Euro 2024, reaching just €1.2 billion. It boasts simultaneously the least expensive group leader in Belgium (€584.5 million) and the least expensive team at the entire tournament – Romania (€92.13 million).