The global COVID-19 pandemic was a major factor that led to a 17% year-over-year decline in the sports betting market value in the UK in 2021. That said, online betting on virtual events peaked during the pandemic, with the highest GGY being recorded in April 2020.

Some of the most popular sporting events that UK punters prefer include football, horse racing, and dog racing. For the months between April 2021 and March 2022, the annual turnover accumulated through off-course horse race betting in the UK amounted to over £3 billion. As for the annual turnover of off-course greyhound race betting in the UK for that period, it amounted to nearly £740 million. Despite these two handles showing a decline in off-course betting annual turnover, football in the UK turned out to be increasingly popular among British punters, with an annual turnover of off-course football betting between April 2021 and March 2022 in the UK amounting to £1.34 billion.

Surprisingly, data from September 2021 showed that the majority of sports fans in the UK did not participate in sports betting, with only 5.6% of the public in the UK engaging in sports betting activities. What is more, despite Ladbrokes being chosen as the brand that most UK punters recognize, most casual bettors in the country cannot name even one betting brand directly.

Even though the UK’s sports betting market has been expanding in the last few years, many believe that this may not be the case in upcoming years. With strict regulations imposed on betting brands and increasing disapproval of betting among the public, the future of the sports betting market in the UK is not very clear.

Sports Betting Receipts Reflecting the Growth of Betting Market in the UK

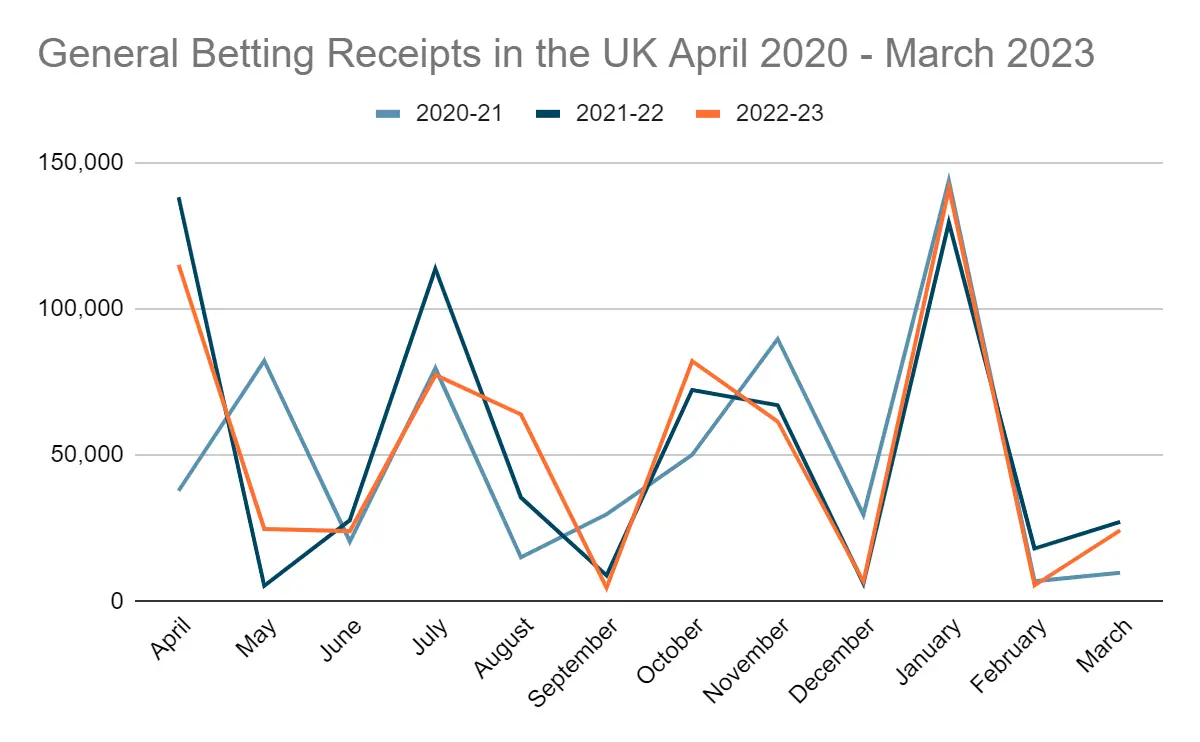

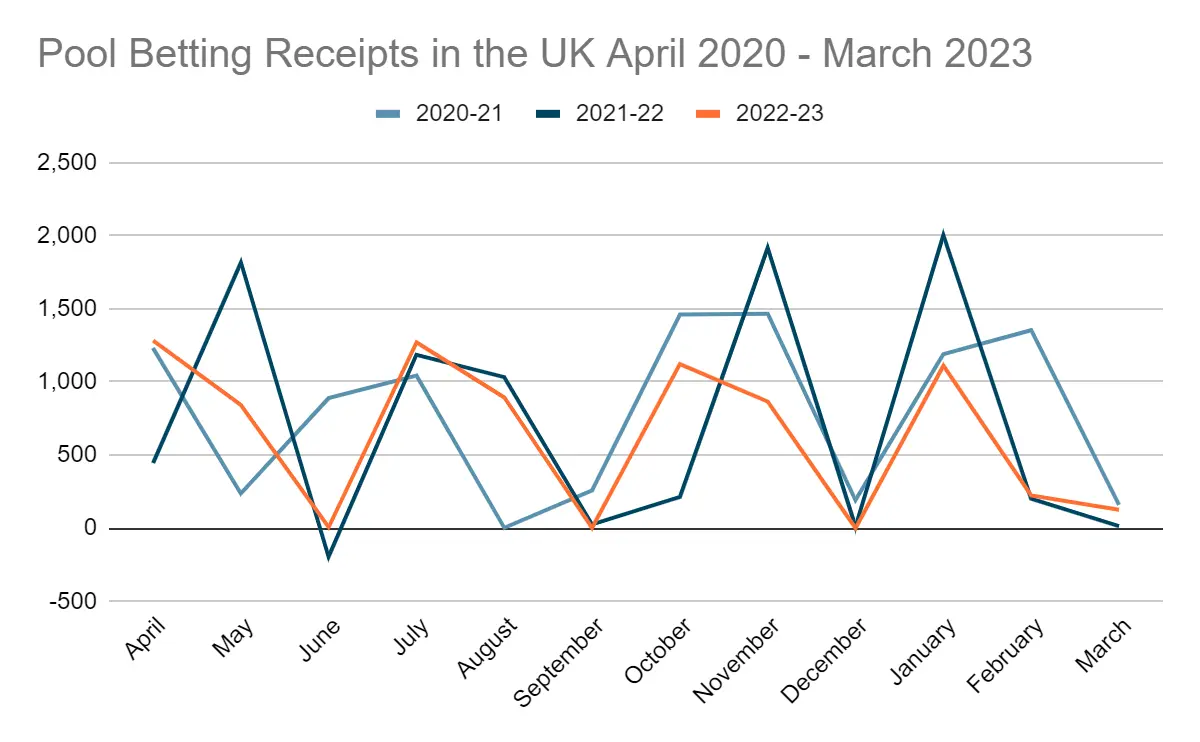

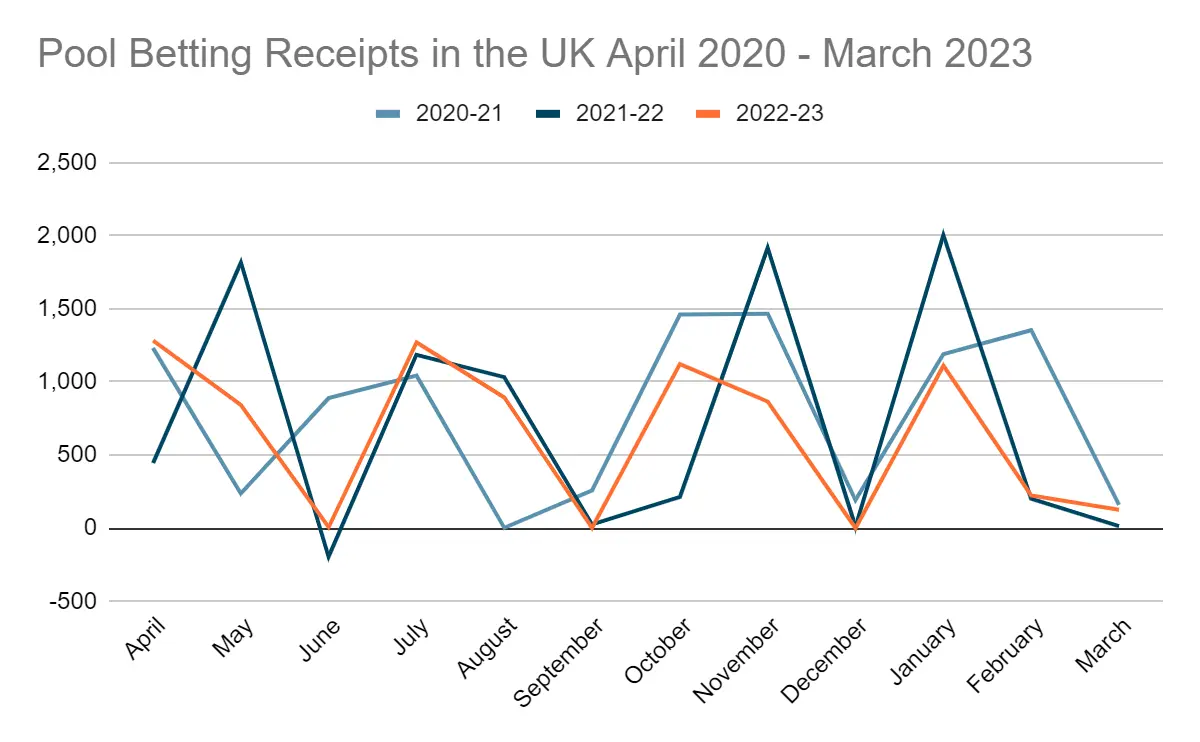

If we take the official publication for the financial year ended March 31 and compare it to the previous two financial years, we can notice a few trends:

- In the last three financial years, there have been seasonal increases in betting in April, July, October, and January

- Instead of following a specific trend throughout the entire financial year, results from 2021-2022 and 2022-2023 financial years are showing specific trends occurring on quarterly basis

- Receipts reported since April 2020 are affected by a series of factors, including the global pandemic that put sports betting on halt for several months

*values used for the table are in £ thousands

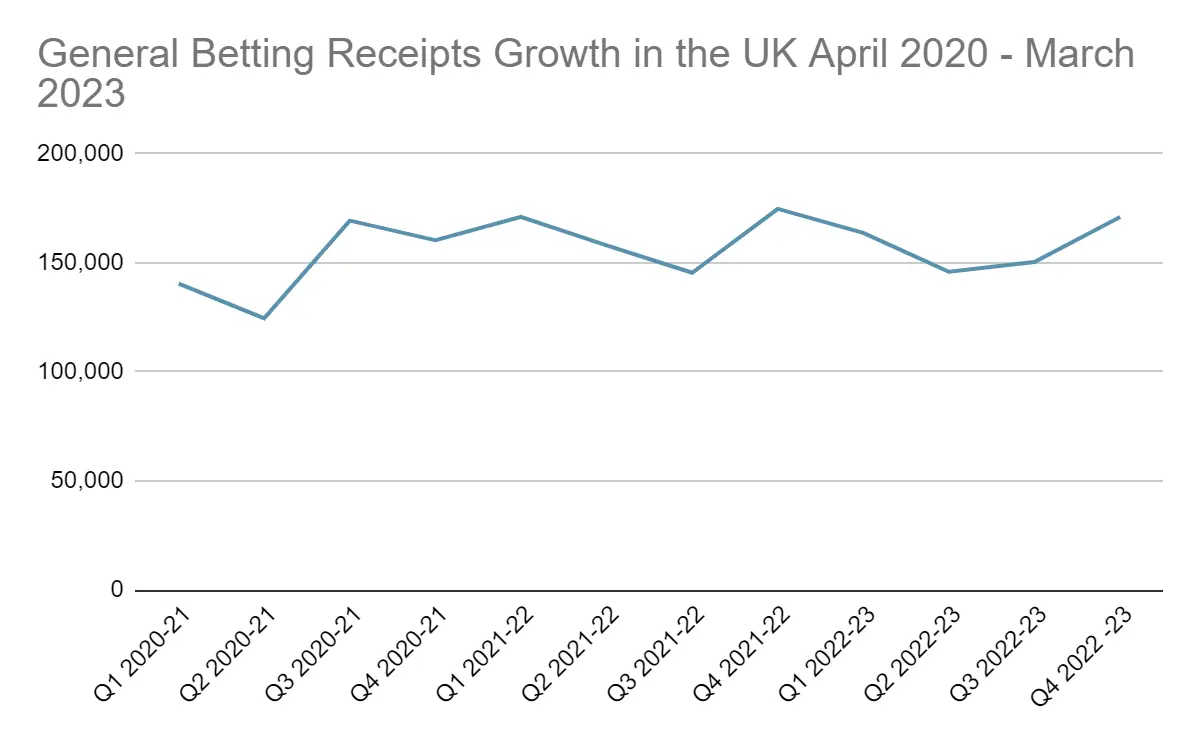

The General betting duty receipts for the financial year 2022-2023 (April 2020 to March 2023) amounted to £631 million, reflecting a 3% year-over-year decline from £649 million generated for the same period of the previous financial year.

When compared to the General betting duty receipts for 2019-2020 financial year, the data for 2022-2023 indicated a 7.7% increase. The slow growth of betting receipts in the UK is most likely due to slowdown of trade and the closure of most gambling venues during the global pandemic in 2020-2021.

*values used for the table are in £ thousands

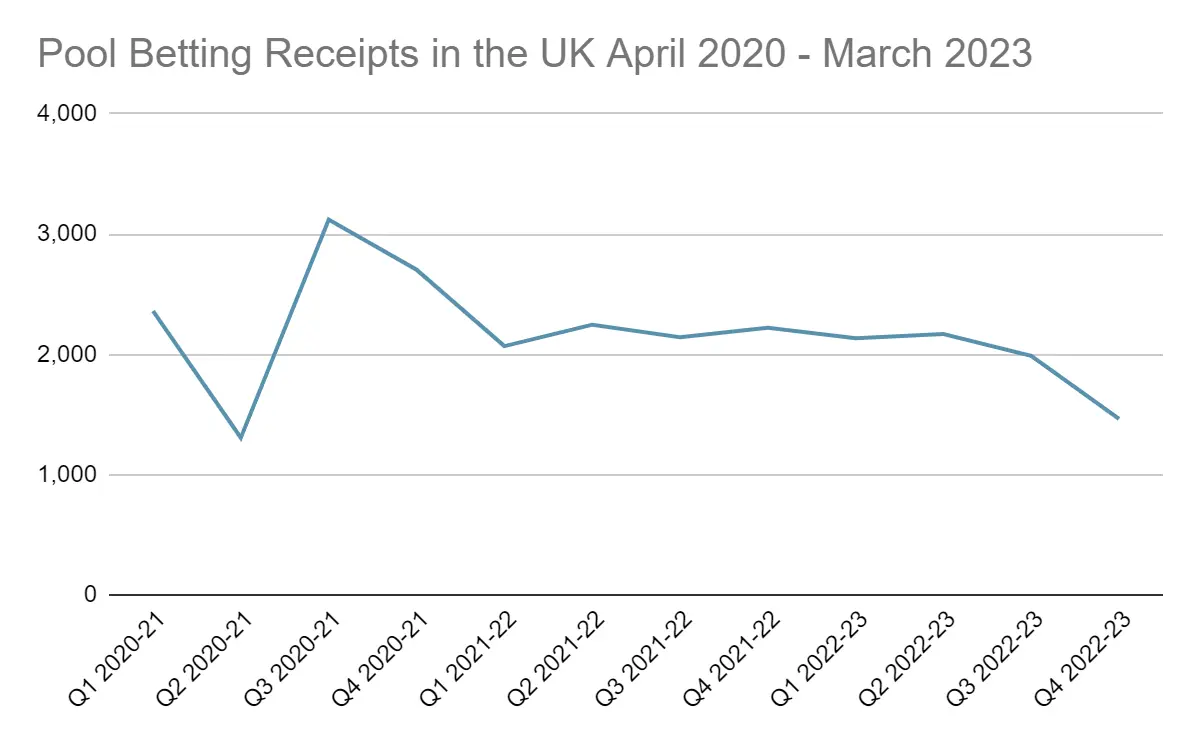

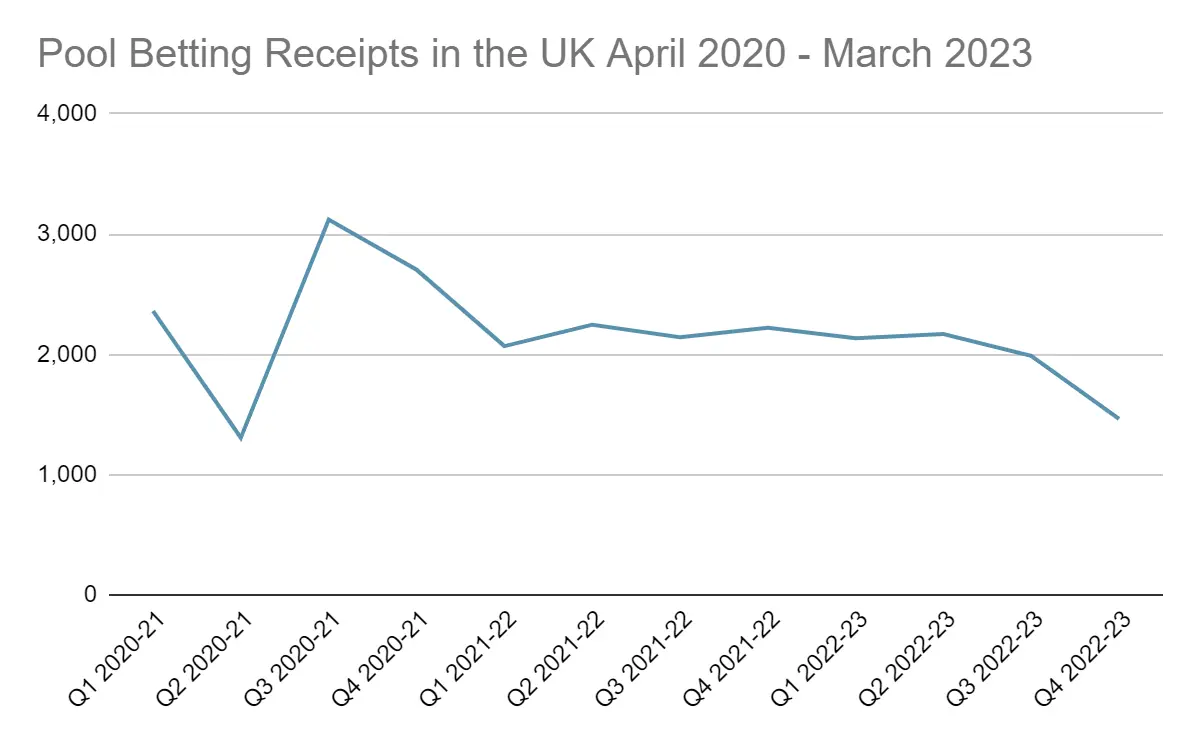

Pool betting duty is charged on non-fixed-odds bets made in UK premises or by UK punters. This duty is charged on the money accumulated through bets minus the money, which was paid out for winnings.

When we compare the pool betting duty receipts for the previous financial years, we notice a few trends:

- The receipts accumulated for the period between April 2022 and March 2023 (financial 2022-2023) amounted to £7.8 million, reflecting a 11% decline from £8.7 million for the previous financial year.

- The year-to-date Pool betting receipts for financial 2020-2021 amounted to £9.5 million, which reflected a 63.8% year-over-year growth, compared to £5.8 million in 2019-2020. However, the year-to-date Pool betting receipts for financial year 2021-2022 amounted to £8.7 million, which showed a decline of almost 9% compared to the previou year.

- The Pool betting receipts from Q1 of 2021-2022 until Q3 of 2022-2023 were pretty much similar for each quarter

*values used for the table are in £ thousands

*values used for the table are in £ thousands

Evolution of the Betting Market in the UK

The data that have been released in August 2023 covered the months from April to June 2023. This period includes the Aintree festival as well as the end of the football season, with both events being drivers for increased interest in sports betting among UK punters. Results released by the UKGC show that Gross Gambling Yield (GGY) for the period between April and June 2023 surged 5%, accumulating to £1.3 billion. One of the main factors that boosted that amount was real event betting, which increased 12% during that period.

| Number of Active Bettors in the UK for Q1 2023-2024 | |||

|---|---|---|---|

| April 2023 | May 2023 | June 2023 | |

| Real Event Betting | 7,291,412 | 5,245,117 | 4,928,477 |

| Betting (Virtual) | 192,641 | 177,335 | 175,531 |

| Number of Sports Betting Wagers Placed in the UK for Q1 2023-2024 | |||

|---|---|---|---|

| April 2023 | May 2023 | June 2023 | |

| Real Event Betting | 389,589,440 | 330,133,477 | 272,518,586 |

| Betting (Virtual) | 9,557,469 | 8,975,494 | 8,782,746 |

| Sports Betting GGY in the UK for Q1 2023-2024 | |||

|---|---|---|---|

| April 2023 | May 2023 | June 2023 | |

| Real Event Betting | £189,787,742 | £205,563,786 | £142,898,832 |

| Betting (Virtual) | £3,593,598 | £3,490,415 | £3,362,535 |

| Betting (eSports) | £891,369 | £1,172,398 | £1,210,192 |

| Total: | £194,272,709 | £210,226,599 | £147,471,559 |

As for in-person sports betting, LBOs have reported GGY for Q1 of £588 million, which indicated a 0.7% increase compared to Q1 of 2022. Meanwhile, the number of total bets and spins has reduced 2% to 3.3 billion.

Leading Sports Betting Brands in the UK for 2023

The ranking is based on data gathered since October 2021, which showed that the event that brought the biggest spike in visits to sports betting sites in the UK was the Cheltenham Festival in March 2022 as well as the Grand National in April 2022. Meanwhile, major sports events like the World Cup 2022 and the Super Bowl in the US were not among the factors that have significant effect on the traffic to sports betting sites in the UK.

The overall traffic to sports betting sites in the UK hit 1.3 billion visits, reflecting a 8% surge compared to visits recorded in 2021

| Top 5 Sports Betting Market Leaders in the UK (October 2023) | |||

|---|---|---|---|

| Rank | Domain | Traffic Share | Visits for Previous Month |

| 1 | bet365.com | 9.55% | 102.7 million |

| 2 | skybet.com | 8.02% | 7.6 million |

| 3 | betfred.com | 7.45% | 11.5 million |

| 4 | williamhill.com | 4.93% | 1.8 million |

| 5 | ladbrokes.com | 4.17% | 4.8 million |

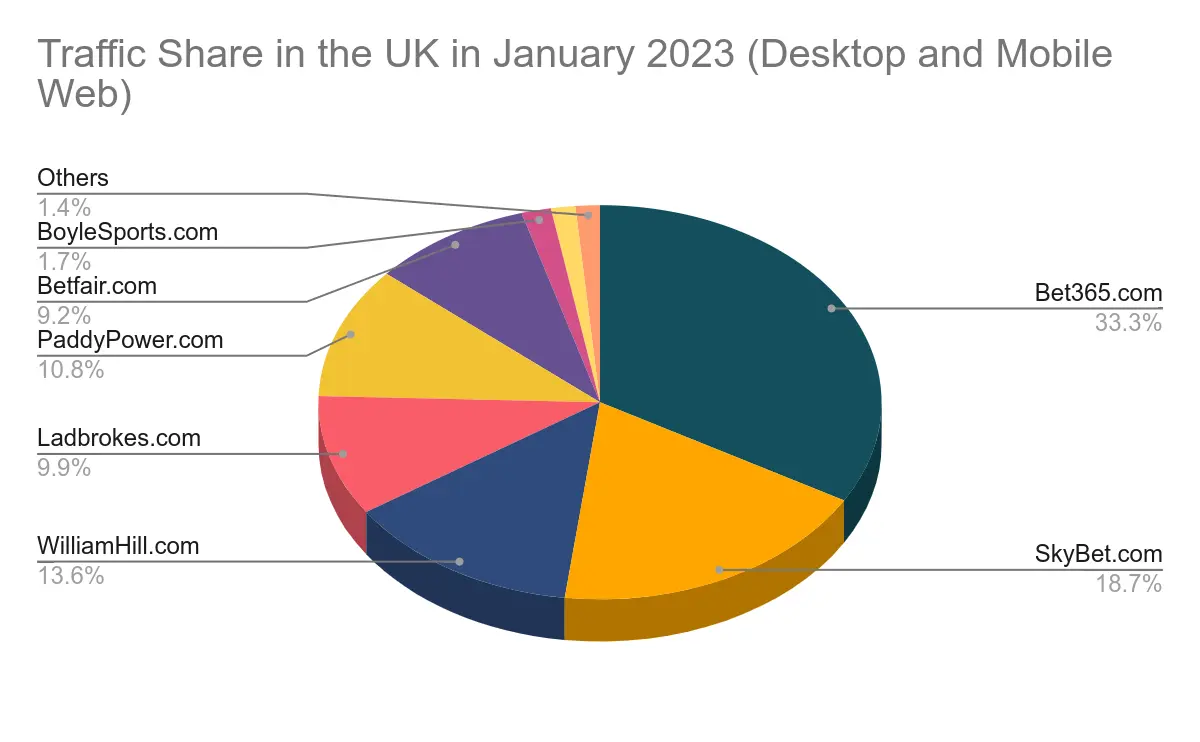

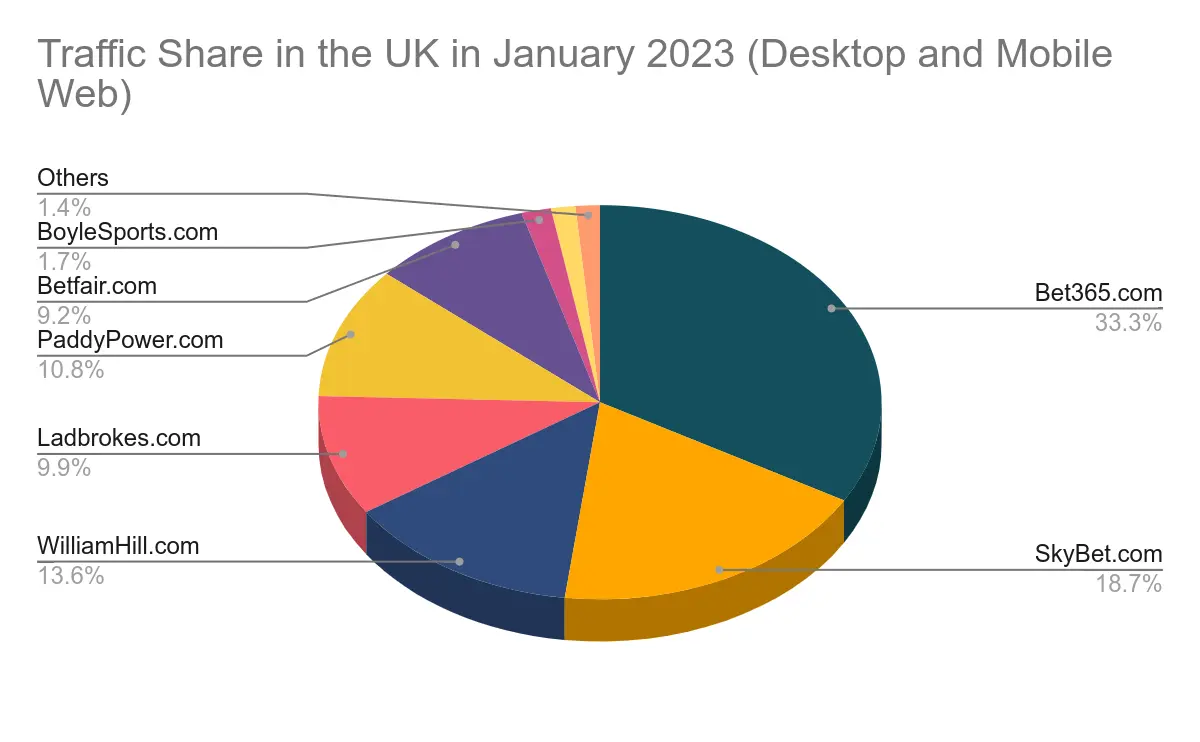

The ranking of the leading sports betting brands in the UK was based on the average traffic each domain has hit every month. When comparing different brands offering sports betting to UK punters, we see that Bet365 has a huge lead over the rest of the betting sites in the country, with the brand holding a 28% share of the monthly traffic among a total of nine peers. This comes as no surprise as Bet365 is also the biggest sports betting site on a global scale.

All sites that were included in the research experienced a significant increase in traffic in March and April of 2022, which was the period of events like the Cheltenham Festival and the Grand National. As both sporting events are significant for the UK audience, it comes as no surprise that they were drivers for spikes in traffic, while global events like World Cup 2022 did not bring any major difference in visits to sports betting sites in the UK.

While the traffic to sports betting sites in the UK rose by 8% in 2022, in January 2023, there was a significant decrease in visits, both on a month-on-month basis as well as year-over-year. Compared to December data, visits to sports betting domains in January 2023 declined by 10%, while the year-over-year decline was 6%.

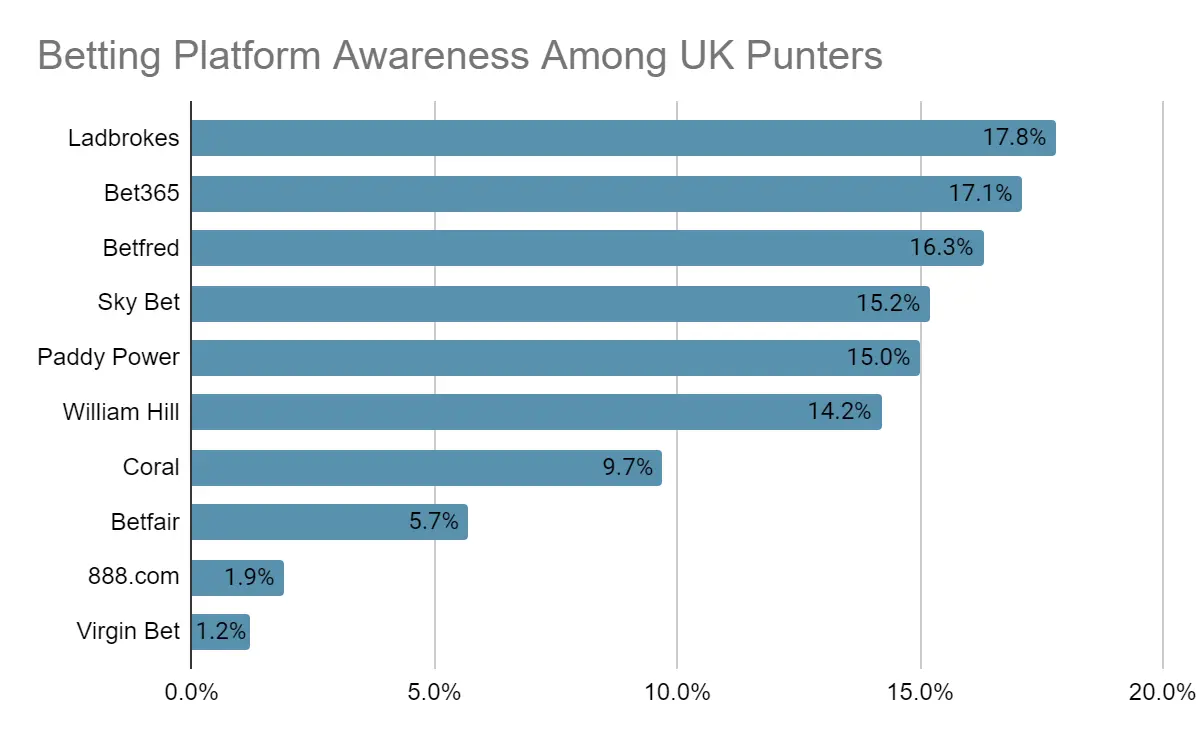

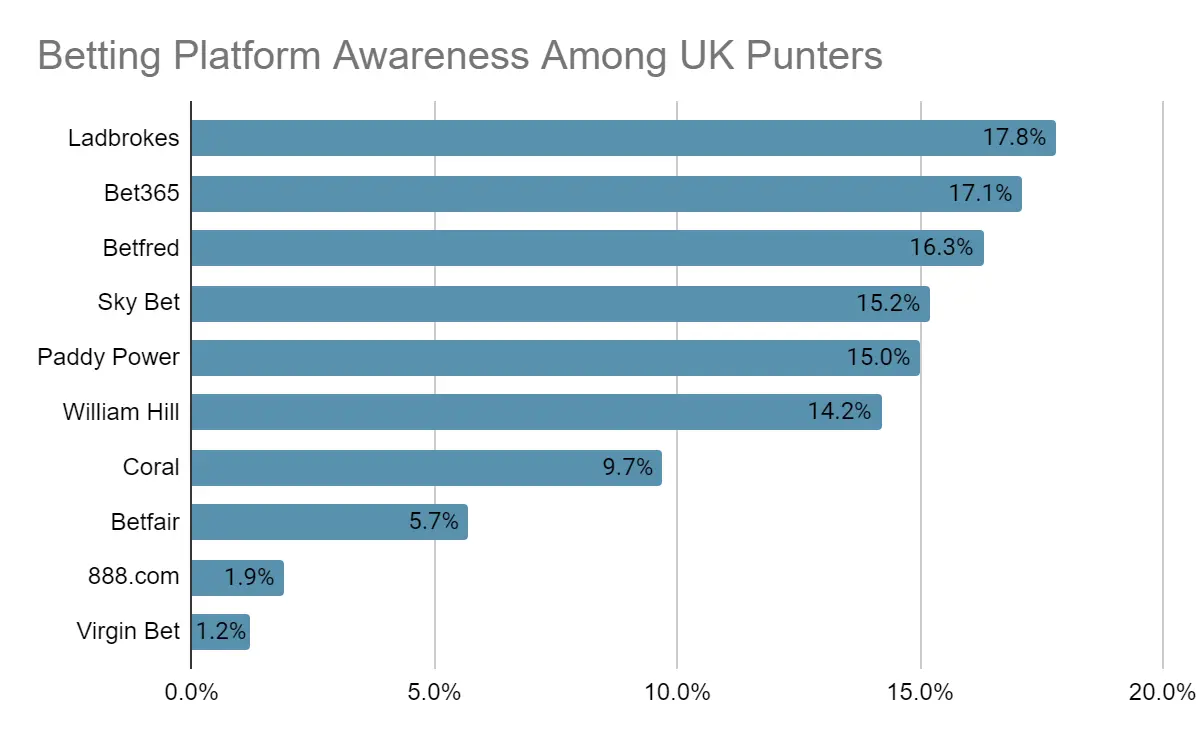

If we consider the popularity of betting brands in the UK rather than the actual traffic betting sites accumulate on a monthly basis, we will notice that local brands, that have set up local partnerships are better known among UK punters. One thing that a study by TGM Research revealed was that occasional bettors in the UK were not able to name a betting platform directly, which showed that most punters tend to pick betting brands based on functionality rather on popularity.

When UK bettors were asked which betting brands they were aware of, Ladbrokes was named by most respondents (17.8%). Bet365 was also well-known among British bettors, with 17.1% of them naming the brand. That said, about 53% of respondents were not able to think of any brand off the top of their heads, while 12% were able to think of one brand. Some 11% of participants in the survey were able to name two brands, 10% were aware of three betting brands, 6% named four betting platforms, and 8% of correspondents were able to name at least five betting brands.

How Popular is Sports Betting among British Bettors?

As for the increasing frequency of sports betting, the same survey revealed that 16% of English bettors were betting more often in the past 12 months, while 41% said they were betting the same amount as they were in the previous 12 months. Some 31% of respondents said they were betting less in the last 12 months and 11% reported having placed a sports bet for the first time in the last 12 months.

Both online and in-person sports betting is more popular among males in the UK, with 25% of males reporting having placed bets online or through an app, while 16% of females have chosen to place sports bets on a betting website or mobile app. Meanwhile, 17% of men in the UK have placed wagers on a sporting event in person, while only 10% of UK women have made sports bets at land-based sportsbooks or casinos in the last 12 months. Adults between the ages of 24 and 34 are the group with the highest number of active sports bettors in the last 12 months in England.

The majority of UK punters (52%)have pointed out the desire to win money as the biggest reason to engage in sports betting. Other popular reasons for this activity among UK punters include making any sporting event more intriguing (35%) as well as the pure excitement of placing bets (32%). The survey also revealed that the majority of UK punters betting on sports are actual fans of the events, players, and teams they bet on. About 73% of correspondents have reported actively watching any sports events they bet on, while 27% said they did not watch every event they placed a wager on.

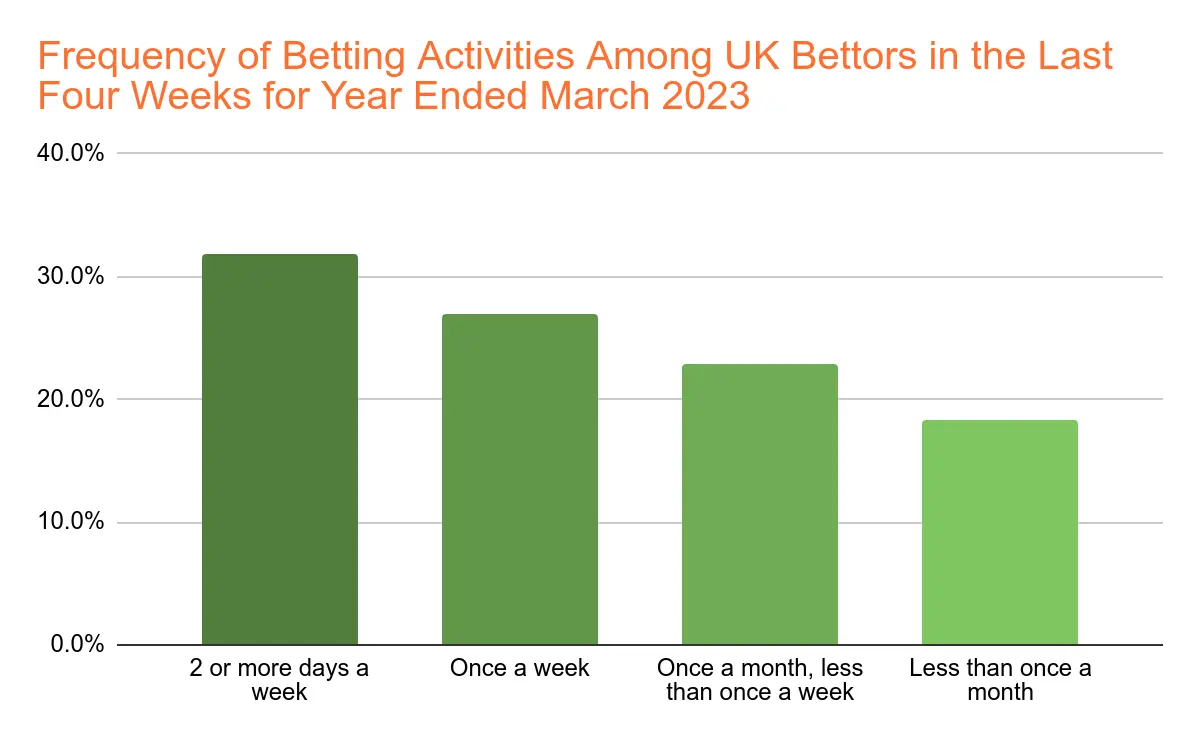

How Often Do UK Punters Bet on Sporting Events?

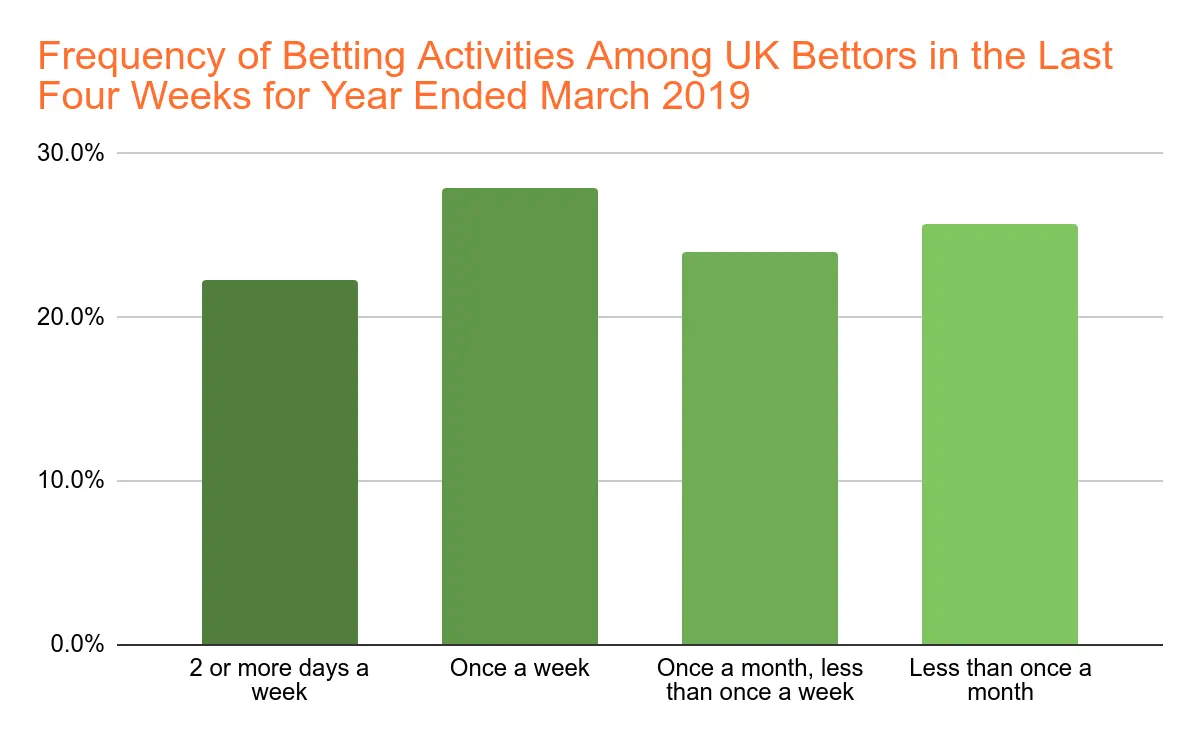

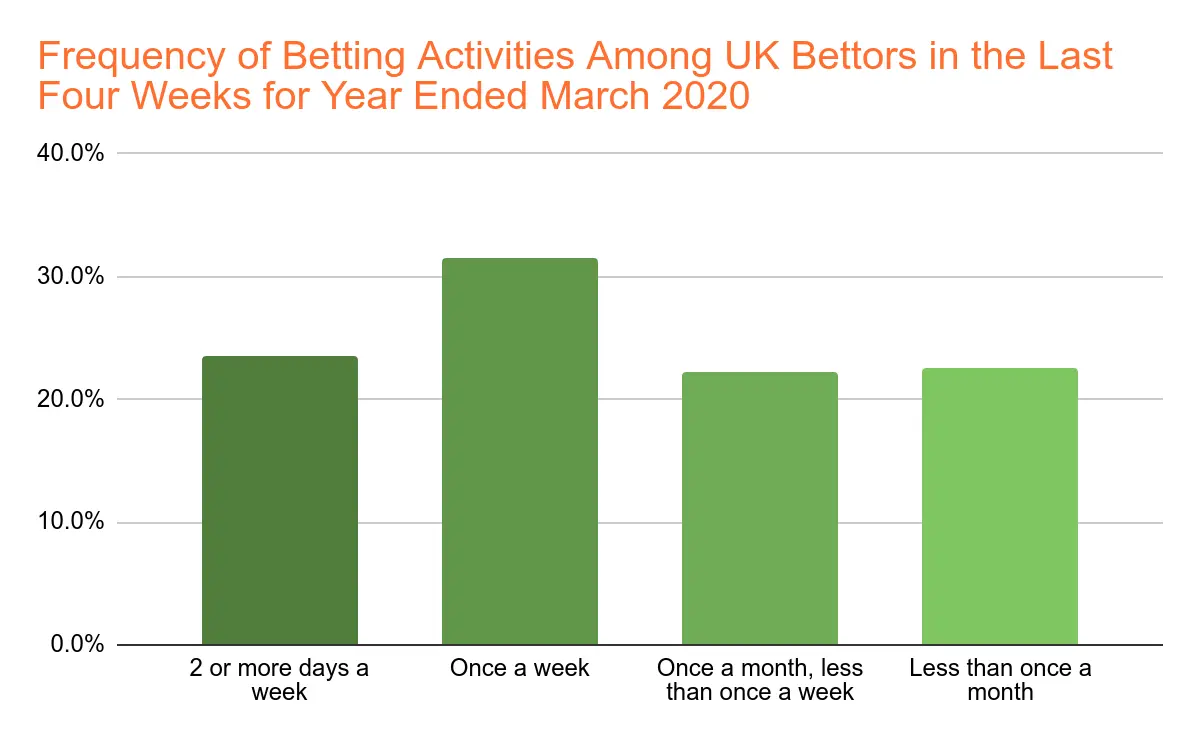

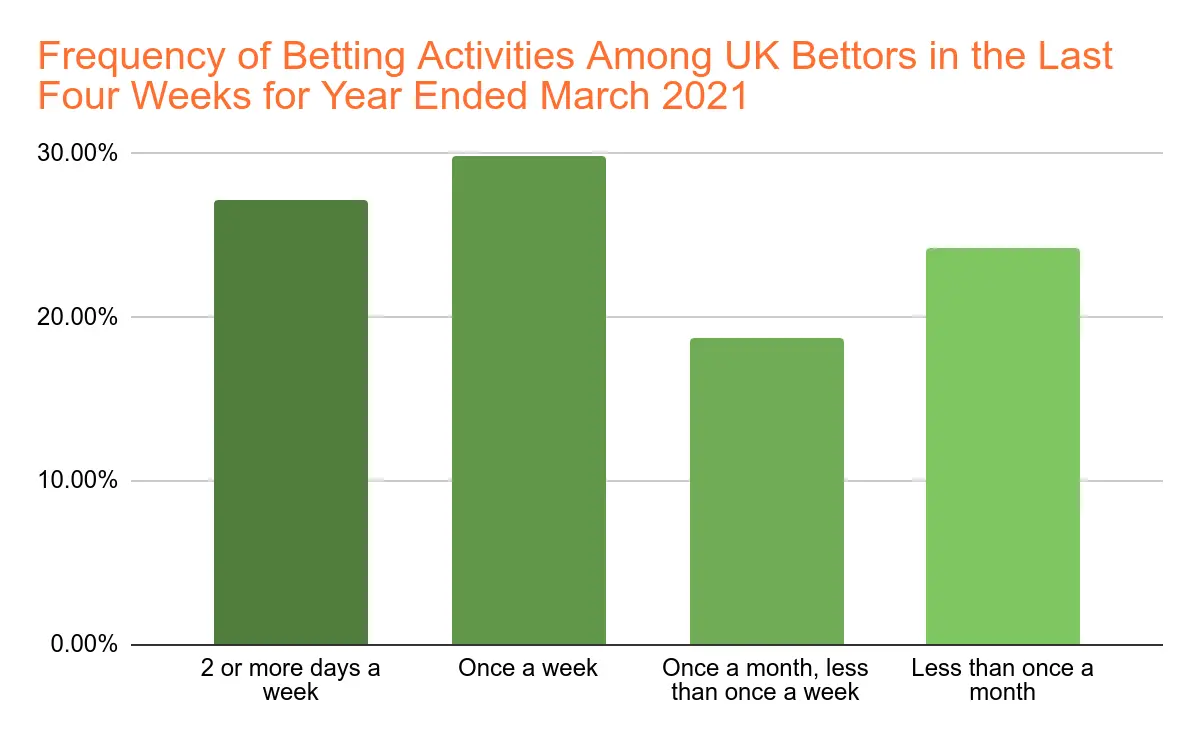

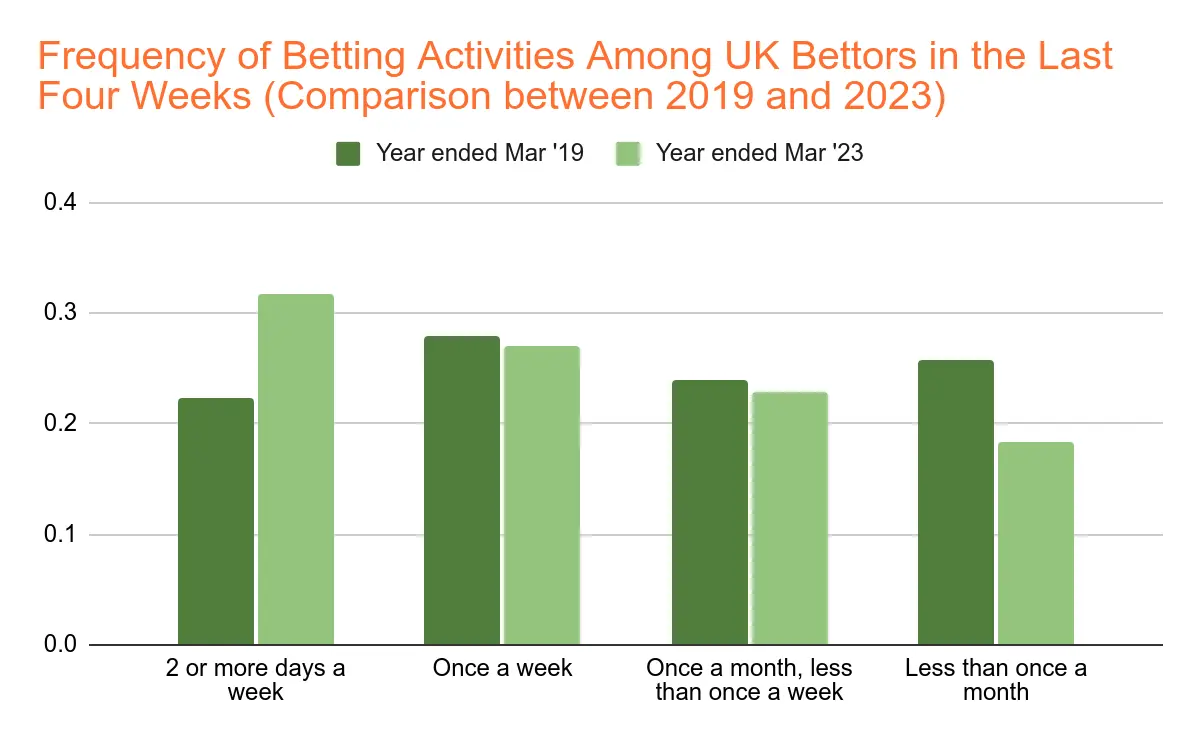

In the year ended March 2020, there was an increase in the number of punters betting two or more times a week as well as the bettors who were placing wagers once a week. Those who were betting less frequently reduced their numbers in the year ended March 2020.

In the year ended March 2021, there was an increase in the numbers of punters who were betting most frequently as well as bettors who enjoyed placing sports bets less than once a month.

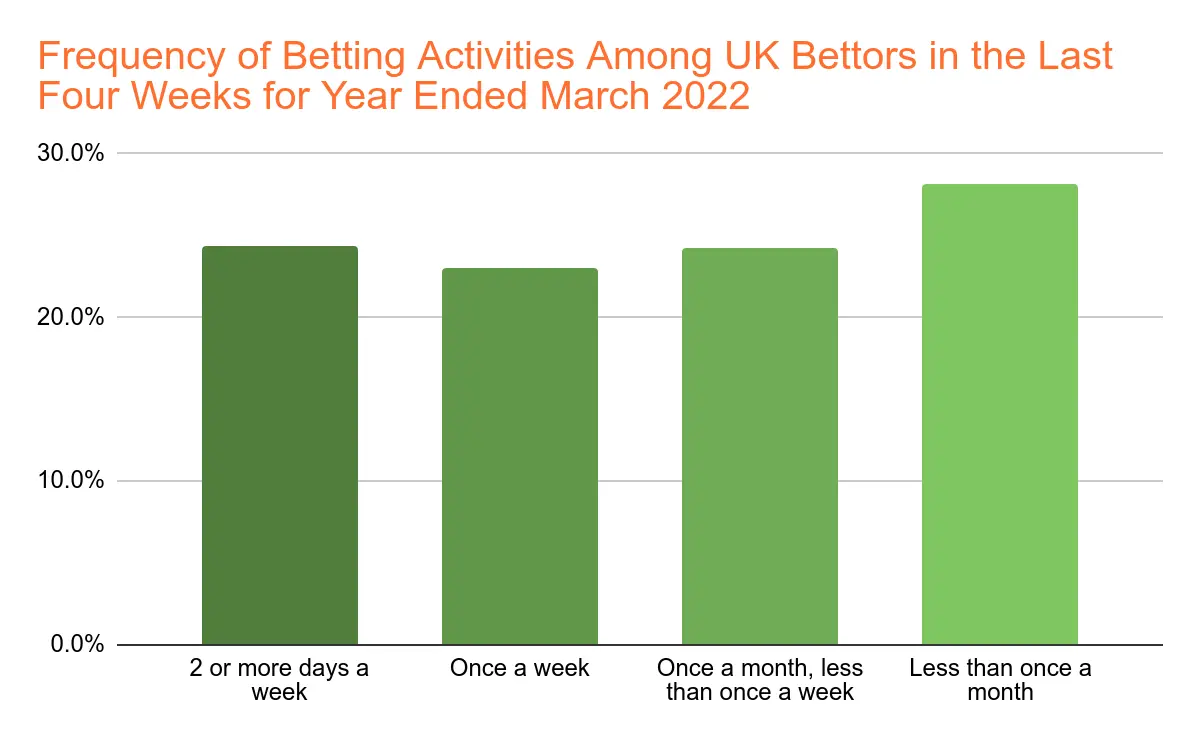

One trend that was pretty clear to identify in the year ended March 2022 was a distinct surge in the number of UK bettors who were engaging in sports betting activities once a month or less than that. Meanwhile, the number of punters who were betting more frequently was reduced compared to the previous year.

The most recent data published by the UKGC showed that the number of UK punters engaging in sports betting activities two or more times a week increased during the year that ended March 2023. There was also a year-over-year surge in the number of punters betting once a week. Compared to the previous year, however, more casual bettors who bet less frequently reduced their number in the year ended March 2023.

If we compare the entire period between the year ended March 2019 and the year March 2023, we will notice that there was a significant increase in the number of UK bettors who place bets two or more times in a week. In 2023, their number represented 31.8% of bettors, which was the highest rate for the last five years. Meanwhile, all other handles experienced a decrease in number, with punters who bet less frequently reducing their number in 2023 compared to 2019.

Problem Gambling Rates Among British Punters

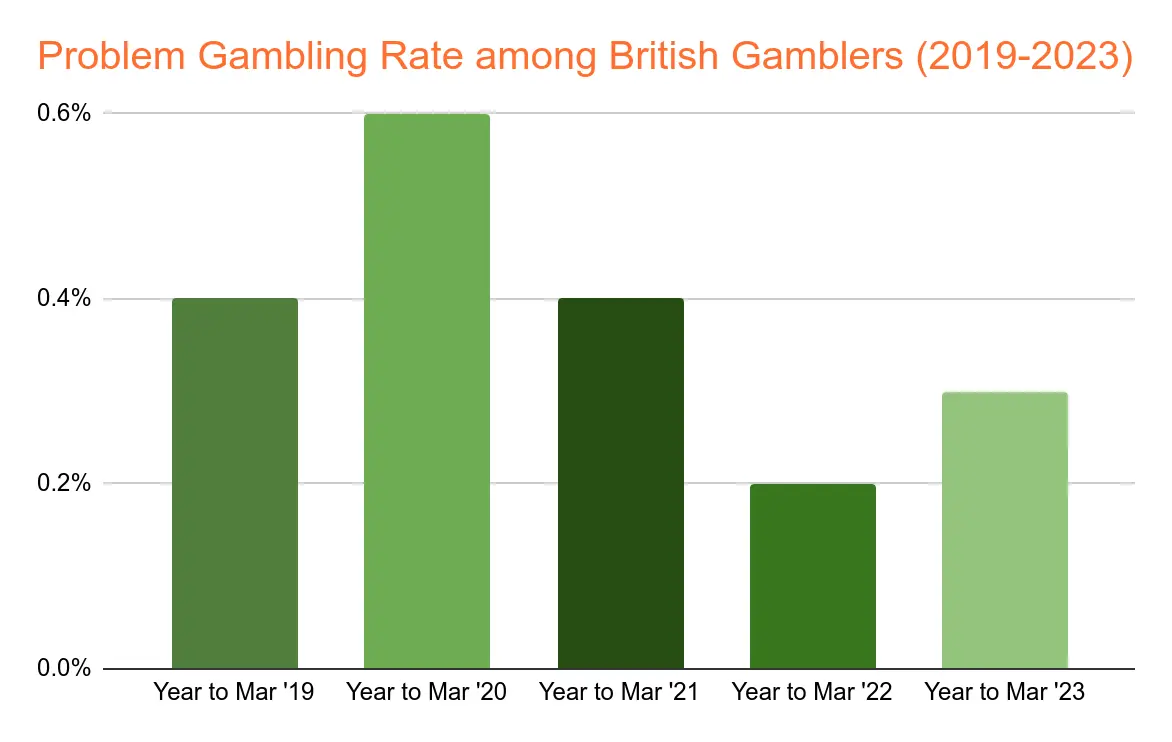

Problem gambling rates among all UK participants in the recent research conducted by the UKGC showed a slight decrease in problem gamblers in the last five years. While problem gambling prevalence according to the research was 0.4% in the year ended March 2019, for the year ended March 2023, it dropped to 0.3%.

As for the problem gambling among British people by gender, each year, the prevalence rate of gambling tends to be higher among males than females. That said, data showed that problem gambling has been increasing among females, with the rate for the year ended March 2019 being below 0% while the most recent results for 2023 revealed problem gambling rate of 0.3% among females in the UK.

As for problem gambling rates among different age groups in the UK, in the last five years, there has been an increase of problem gambling among individuals that fall under the age groups of 16-24 years olds and 25-34 years olds.

| Problem Gambling Rate in the UK by Age Groups (2019 – 2023) | ||||||

|---|---|---|---|---|---|---|

| 16-24 year olds | 25-34 year olds | 35-44 year olds | 45-54 year olds | 55-64 year olds | 65+ year olds | |

| Year ended Mar ’19 | 0.70% | 0.10% | 1.10% | 0.30% | 0.30% | 0.10% |

| Year ended Mar ’20 | 1.00% | 1.30% | 0.80% | 0.20% | 0.30% | 0.20% |

| Year ended Mar ’21 | 0.40% | 0.30% | 1.10% | 0.40% | 0.40% | ~ |

| Year ended Mar ’22 | 0.80% | 0.20% | 0.20% | ~ | 0.30% | 0.10% |

| Year ended Mar ’23 | 1.00% | 0.80% | 0.60% | – | – | – |

~ values are too low to be expressed with a rate

– no values available

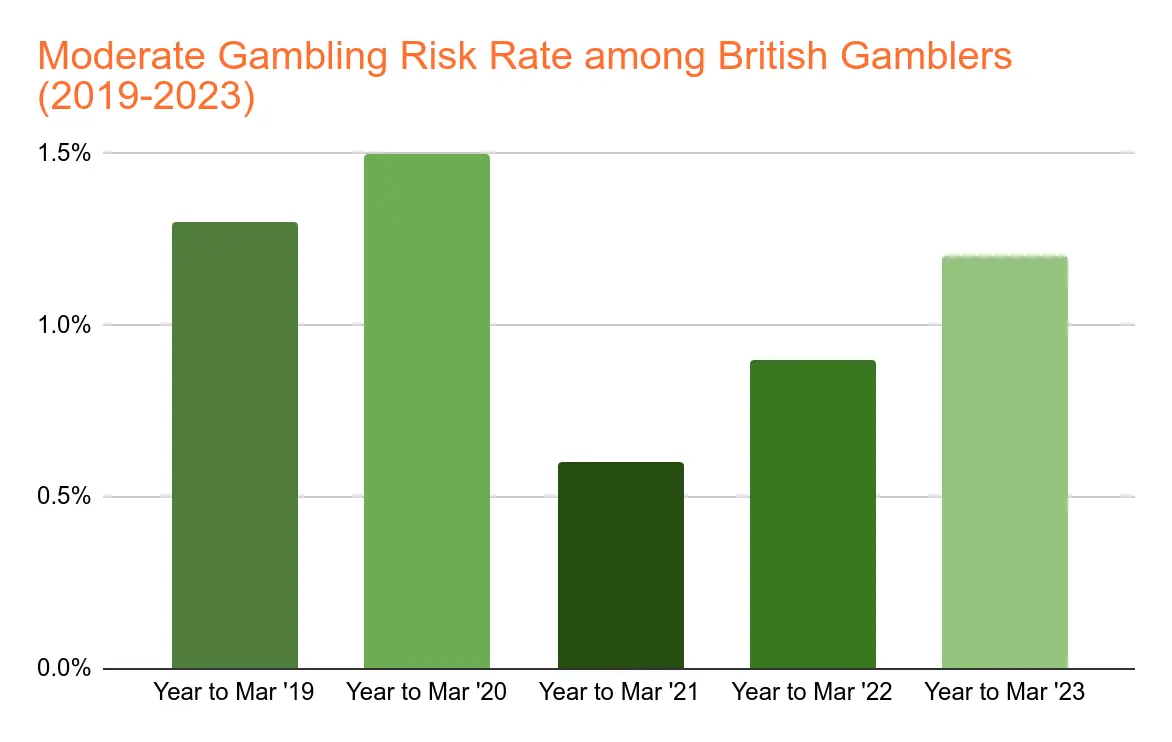

As far as moderate gambling problem rate goes, data published by the UKGC showed that there has been a decline in UK bettors experiencing moderate gambling risk for the years ended March 2021 and March 2022. However, by the year ended March 2023 moderate gambling risk rates reached almost the same level as in 2019, showing a slightly lower rate in 2023.

Moderate gambling risk is also higher among males in the UK, however, after the global pandemic, the difference between males and females is getting smaller in the last few years, with the moderate gambling risk being 0.9% for both genders in the year ended March 2022. Another trend that should be mentioned is that while moderate gambling risk rate has reduced among males between 2019 and 2023, with females, that rate has increased during the course of the past five years.

When comparing the data between the year ended March 2019 and the year ended March 2023, we saw that there has been an increase in moderate gambling risk rate in the age groups between 16 and 24 years, 35 and 44 years as well as 55 and 64 years.

| Moderate Gambling Risk Rate in the UK by Age Groups (2019 – 2023) | ||||||

|---|---|---|---|---|---|---|

| 16-24 year olds | 25-34 year olds | 35-44 year olds | 45-54 year olds | 55-64 year olds | 65+ year olds | |

| Year ended Mar ’19 | 1.80% | 2.50% | 1.20% | 0.90% | 0.70% | 0.90% |

| Year ended Mar ’20 | 4.30% | 1.70% | 1.90% | 1.20% | 1.00% | 0.30% |

| Year ended Mar ’21 | 0.90% | 0.90% | 0.60% | 0.80% | 0.60% | ~ |

| Year ended Mar ’22 | 2.90% | 1.50% | 0.60% | 0.80% | 0.30% | 0.20% |

| Year ended Mar ’23 | 1.90% | 1.80% | 2.30% | 0.50% | 1.30% | 0.30% |

~ values are too low to be expressed with a rate

– no values available

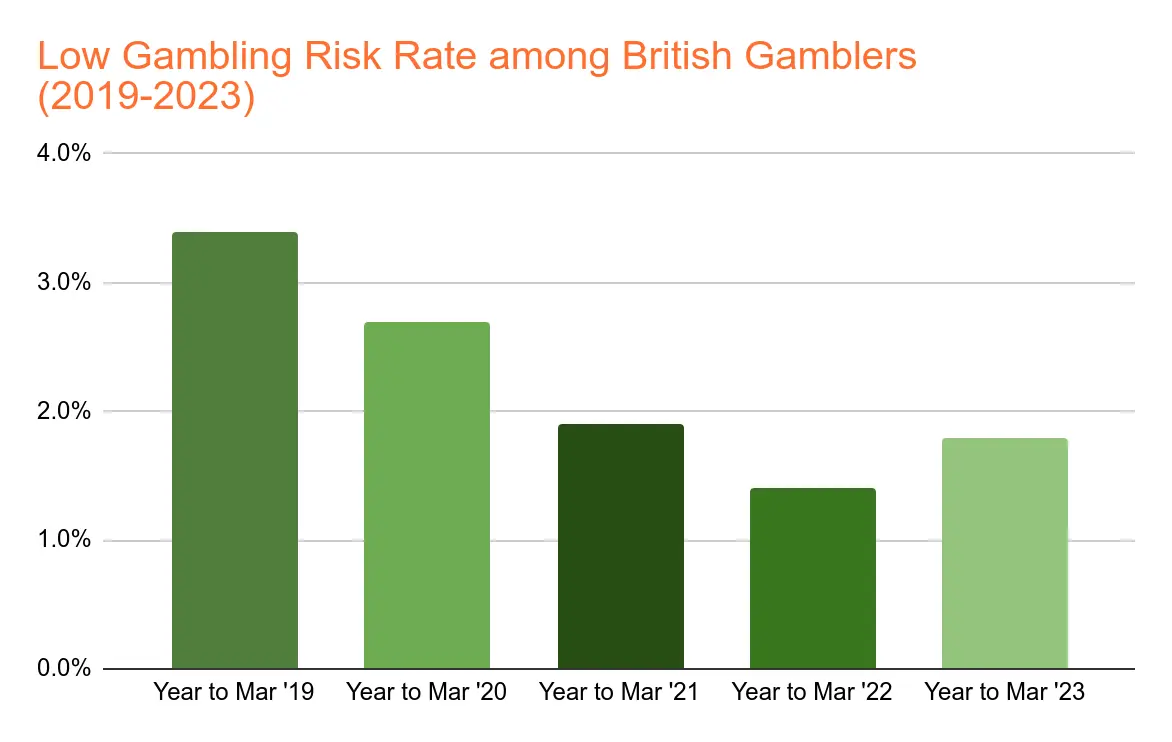

The UKGC has also provided data on low risk rates in the UK between 2019 and 2023. When we take a general look at all participants in the Gambling Participation survey conducted by the regulator, we can see that the number of participants who fall into the category of low gambling risk gamblers decreased significantly between 2019 and 2023.

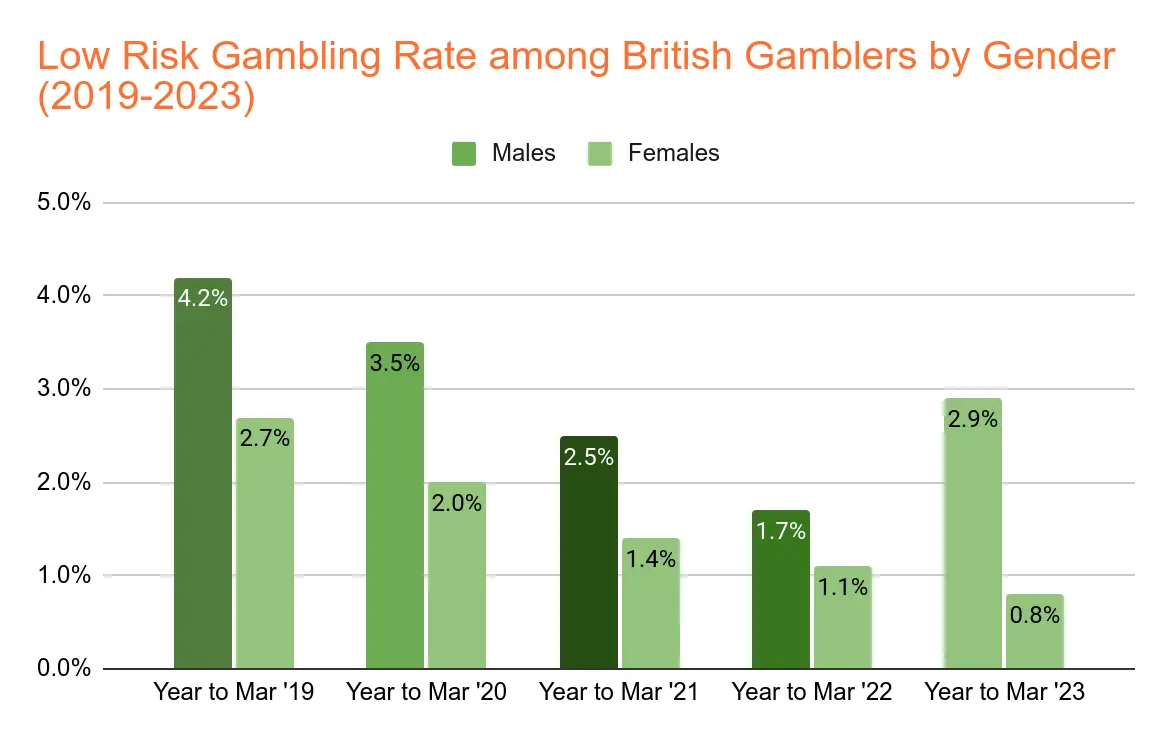

As for the distribution of low risk gamblers in the UK, we still have more males than females experiencing low-level gambling risks while betting. That said, both females and males have reduced their low gambling risk rate in the year ended 2023, expressing a significant decline compared to the rates recorded in the year ended March 2019.

As for the age distribution among UK bettors experiencing low gambling risk between 2019 and 2023, data showed that there has been a decline in the gambling risk rate in almost every age group but the one including 65+ years olds. In the year ended March 2019, the age group between 16 and 24 and the one including individuals between 25 and 34 reported low gambling risk rates of 5.8% and 6.4% respectively. In the year ended 2023, these rates reduced to 1.9% and 2.3%, respectively.

| Low Gambling Risk Rate in the UK by Age Groups (2019 – 2023) | ||||||

|---|---|---|---|---|---|---|

| 16-24 year olds | 25-34 year olds | 35-44 year olds | 45-54 year olds | 55-64 year olds | 65+ year olds | |

| Year ended Mar ’19 | 5.80% | 6.40% | 3.70% | 2.30% | 1.70% | 1.50% |

| Year ended Mar ’20 | 4.90% | 5.80% | 3.00% | 1.40% | 1.30% | 1.10% |

| Year ended Mar ’21 | 2.40% | 3.60% | 2.80% | 1.40% | 1.50% | 0.50% |

| Year ended Mar ’22 | 2.20% | 2.20% | 1.20% | 1.10% | 1.10% | 1.10% |

| Year ended Mar ’23 | 1.90% | 2.30% | 2.30% | 1.90% | 0.70% | 1.80% |

~ values are too low to be expressed with a rate

– no values available

Sports Betting Activity Recorded in the UK After the Global Pandemic

| Number of Active Bettors in the UK for Financial 2022 – 2023 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr’ 22 | 7,677,460 | 236,914 |

| May ’22 | 5,640,833 | 236,080 |

| Jun ’22 | 4,565,152 | 212,673 |

| Jul ’22 | 4,573,576 | 211,955 |

| Aug ’22 | 5,666,882 | 212,761 |

| Sep ’22 | 4,900,242 | 207,544 |

| Oct ’22 | 5,515,230 | 212,368 |

| Nov ’22 | 5,967,896 | 212,610 |

| Dec ’22 | 5,870,127 | 234,851 |

| Jan ’23 | 5,373,648 | 232,153 |

| Feb ’23 | 5,541,981 | 212,364 |

| Mar ’23 | 6,655,084 | 233,605 |

| Total: | 67,948,111 | 2,655,878 |

Official data by the UKGC revealed that the total number of sports bettors on real events for the financial year ended March 31, 2023 amounted to 67,948,111, which revealed a 7.4% increase compared to the number of real event bettors for the same period of the previous financial year. The data also showed that the number of UK virtual sports bettors in 2022-2023 was 2,655,878, which was an 8.3% decline from the number recorded for the financial year 2021-2022.

| Number of Active Bettors in the UK for Financial 2021 – 2022 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr’ 21 | 6,708,650 | 256,232 |

| May ’21 | 5,127,997 | 236,059 |

| Jun ’21 | 5,596,180 | 216,974 |

| Jul ’21 | 5,505,234 | 225,982 |

| Aug ’21 | 4,695,334 | 227,187 |

| Sep ’21 | 4,990,694 | 230,173 |

| Oct ’21 | 4,923,936 | 251,537 |

| Nov ’21 | 4,699,434 | 230,137 |

| Dec ’21 | 4,881,497 | 244,864 |

| Jan ’22 | 4,747,670 | 268,375 |

| Feb ’22 | 4,982,125 | 274,853 |

| Mar ’22 | 6,383,180 | 232,750 |

| Total: | 63,241,931 | 2,895,123 |

The statistics for financial year 2021-2022 revealed that sports betting was slowly recovering from the global pandemic’s consequences, with the number of active real event bettors in the UK surging by 24.7%, reaching a total of 63,241,931. The number of active UK bettors across the virtual betting handle declined 7.9%, reaching 2,895,123 during the financial year 2021-2022.

| Number of Active Bettors in the UK for Financial 2020 – 2021 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr’ 20 | 2,074,003 | 558,067 |

| May ’20 | 2,237,628 | 287,778 |

| Jun ’20 | 4,041,430 | 244,219 |

| Jul ’20 | 4,193,051 | 224,052 |

| Aug ’20 | 3,788,162 | 203,563 |

| Sep ’20 | 4,315,007 | 204,239 |

| Oct ’20 | 4,616,960 | 211,144 |

| Nov ’20 | 4,804,643 | 225,427 |

| Dec ’20 | 4,955,303 | 246,687 |

| Jan ’21 | 4,832,863 | 239,019 |

| Feb ’21 | 4,823,410 | 227,621 |

| Mar ’21 | 6,015,623 | 269,984 |

| Total: | 50,698,083 | 3,141,800 |

Despite showing a slow increase in the number of sports bettors, the gambling industry in the UK continued its trend of accumulating more real event bettors in the first three months of financial year 2023-2024. However, virtual betting active users continue to decline.

| Number of Active Bettors in the UK for Q1 of 2023 – 2024 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’23 | 7,291,412 | 192,641 |

| May ’23 | 5,245,117 | 177,335 |

| Jun ’23 | 4,928,477 | 175,531 |

| Total: | 17,465,006 | 545,507 |

Latest data released from the UKGC revealed that the number of active bettors in the UK for the Q1 of financial year 2023-2024 were 17,465,006 for real event betting and 545,507 for virtual bets. Compared to the numbers recorded during the Q1 of the previous financial year. There was a drop in both handles. The number of real event bettors reduced 2.3% year-over-year, while virtual bettors were 20.4% fewer than those betting during the same period of the previous year.

| Number of Active Bettors in the UK for Q1 of 2022 – 2023 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’22 | 7,677,460 | 236,914 |

| May ’22 | 5,640,833 | 236,080 |

| Jun ’22 | 4,565,152 | 212,673 |

| Total: | 17,883,445 | 685,667 |

Since we are comparing the same period over the financial years during and after the global pandemic, we also took a look at the number of active bettors for financial year 2022-2023, which amounted to 17,883.445 for real event bets and 685,667 for virtual sports bets. When compared to the results for Q1 of financial year 2021-2022, we saw a 2.6% increase in real event bets but also a 3.3% decline in virtual sports bets.

| Number of Active Bettors in the UK for Q1 of 2021 – 2022 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’21 | 6,708,650 | 256,232 |

| May ’21 | 5,127,997 | 236,059 |

| Jun ’21 | 5,596,180 | 216,974 |

| Total: | 17,432,827 | 709,265 |

As for the first three months of the financial year 2021-2022, we saw a huge surge in real event betting users. The total number of active bettors placing real event wagers in the UK during Q1 of 2021-2022 was 17,432,827, reflecting a 108.7% increase compared to the Q1 of financial year 2020-2021. Meanwhile, virtual sports bettors saw a 34.9% decline in their numbers during the first three months of the financial year compared to Q1 in 2020-2021.

| Number of Active Bettors in the UK for Q1 of 2020 – 2021 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’20 | 2,074,003 | 558,067 |

| May ’20 | 2,237,628 | 287,778 |

| Jun ’20 | 4,041,430 | 244,219 |

| Total: | 8,353,061 | 1,090,064 |

To draw a comparison to pre-pandemic levels and the beginning of the global pandemic in the UK, we can check the numbers of active bettors in March 2019 and March 2020. The number of active real events bettors and virtual sports bettors in March 2019 was 5,196,310 and 206,536, respectively. In March 2020, those numbers were 4,629,851 of real event bettors and 388,397 of virtual sports bettors. While the number of active users in virtual betting experienced a 88% increase, the number of real event bettors reduced by 11% year-over-year.

The popularity of sports betting in the UK can also be tracked when comparing the number of sports bets placed in the last few years, which also include the months during the global pandemic.

| Number of Bets Placed by UK Punters in Financial Year 2022-2023 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’22 | 334,177,769 | 12,520,884 |

| May ’22 | 309,323,221 | 11,875,579 |

| Jun ’22 | 275,551,219 | 10,891,057 |

| Jul ’22 | 278,533,218 | 11,260,469 |

| Aug ’22 | 303,810,896 | 10,922,987 |

| Sep ’22 | 288,537,056 | 10,622,276 |

| Oct ’22 | 339,108,866 | 10,699,072 |

| Nov ’22 | 311,787,190 | 10,698,656 |

| Dec ’22 | 294,768,818 | 12,219,998 |

| Jan ’23 | 314,641,543 | 10,913,591 |

| Feb ’23 | 287,195,624 | 9,787,211 |

| Mar ’23 | 376,141,285 | 11,517,432 |

| Total: | 3,713,576,705 | 133,929,212 |

For the financial year 2022-2023, the number of bets placed by UK punters amounted to more than 3.7 billion on real events, while virtual sports bets were almost 134 million. Compared to the betting numbers for the previous financial year, real event bets marked a 13.3% year-over-year increase. Meanwhile, the number of virtual bets has decreased by 18.5% year-over-year.

| Number of Bets Placed by UK Punters in Financial Year 2021-2022 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’21 | 344,316,231 | 17,077,249 |

| May ’21 | 299,821,784 | 15,422,715 |

| Jun ’21 | 272,566,972 | 13,422,847 |

| Jul ’21 | 252,139,493 | 13,387,296 |

| Aug ’21 | 249,797,845 | 13,773,607 |

| Sep ’21 | 255,004,323 | 12,675,371 |

| Oct ’21 | 275,480,062 | 13,627,726 |

| Nov ’21 | 249,659,453 | 12,846,306 |

| Dec ’21 | 259,128,098 | 14,436,745 |

| Jan ’22 | 247,589,560 | 13,063,045 |

| Feb ’22 | 248,008,812 | 11,671,969 |

| Mar ’22 | 323,198,982 | 12,881,152 |

| Total: | 3,276,711,615 | 164,286,028 |

| Number of Bets Placed by UK Punters in Financial Year 2020-2021 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’20 | 78,043,401 | 28,493,303 |

| May ’20 | 104,047,069 | 23,953,845 |

| Jun ’20 | 255,480,430 | 19,382,796 |

| Jul ’20 | 267,219,935 | 16,782,985 |

| Aug ’20 | 235,873,133 | 14,850,352 |

| Sep ’20 | 246,623,124 | 13,656,108 |

| Oct ’20 | 275,974,965 | 15,058,599 |

| Nov ’20 | 286,115,529 | 16,519,746 |

| Dec ’20 | 293,042,579 | 17,443,932 |

| Jan ’21 | 301,082,340 | 17,812,133 |

| Feb ’21 | 296,907,830 | 16,414,815 |

| Mar ’21 | 375,179,619 | 18,399,267 |

| Total: | 3,015,589,954 | 218,767,881 |

To indicate the way the global pandemic has impacted sports betting in the UK, we can also compare the number of bets placed in March 2019 and March 2020 when the global pandemic started having an impact on the betting and gambling industry in the country. The number of real event bets in March 2020 reached 191,510,967, which indicated a 30.1% decline compared to 275,866,481 real event bets made in March 2019. Meanwhile, there was a serious year-over-year surge of 40.1% in virtual bets recorded in March 2020, reaching 20,745,640.

| Number of Bets Placed by UK Punters in Q1 of 2023 – 2024 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’23 | 389,589,440 | 9,557,469 |

| May ’23 | 330,133,477 | 8,975,494 |

| Jun ’23 | 272,518,586 | 8,782,746 |

| Total: | 992,241,503 | 27,315,709 |

As of August 2023, the UKGC has provided sports betting data up until the Q1 of the financial year 2023-2024. The number of real event bets in the UK for the Q1 ended in June 2023 amounted to 992,241,503. These results indicated an 8% growth compared to Q1 of financial 2022-2023. As for the bets placed on virtual sports, their number reached 27,315,709 in Q1 of financial 2023-2024, which was 22.6% lower than the number recorded in Q1 of financial year 2022-2023.

| Number of Bets Placed by UK Punters in Q1 of 2022 – 2023 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’22 | 334,177,769 | 12,520,884 |

| May ’22 | 309,323,221 | 11,875,579 |

| Jun ’22 | 275,551,219 | 10,891,057 |

| Total: | 919,052,209 | 35,287,520 |

In the financial year 2022-2023, UK punters placed 919,052,209 real event bets during the first quarter of the fiscal period. This indicated a 0.3% increase compared to the number recorded for the same period of the previous financial year. As for virtual betting, the number of bets placed during the Q1 period of financial 2022-2023 reached 35,287,520, which was 23.2% less than the number reported during Q1 of 2021-2022.

| Number of Bets Placed by UK Punters in Q1 of 2021 – 2022 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’21 | 344,316,231 | 17,077,249 |

| May ’21 | 299,821,784 | 15,422,715 |

| Jun ’21 | 272,566,972 | 13,422,847 |

| Total: | 916,704,987 | 45,922,811 |

As sports betting was trying to recover from the losses during the global pandemic, the number of real events bets placed during the Q1 period of financial 2021-2022 reached 916,704,987, which reflected a 109.5% increase compared to Q1 of financial 2020-2021. Meanwhile, the number of virtual bets started declining, reaching 45,922,811 in Q1 of financial 2021-2022. This number resulted in a 36.1% year-over-year decline.

| Number of Bets Placed by UK Punters in Q1 of 2020 – 2021 | ||

|---|---|---|

| Month | Betting (Real event) | Betting (virtual) |

| Apr ’20 | 78,043,401 | 28,493,303 |

| May ’20 | 104,047,069 | 23,953,845 |

| Jun ’20 | 255,480,430 | 19,382,796 |

| Total: | 437,570,900 | 71,829,944 |

Sports Betting GGY in the UK Between April 2020 and March 2023

| Betting (Real Event) GGY Financial Year 2022-2023 | |

|---|---|

| Month | Betting (Real event) |

| Apr ’22 | £180,086,956 |

| May ’22 | £168,773,273 |

| Jun ’22 | £130,572,941 |

| Jul ’22 | £128,648,580 |

| Aug ’22 | £169,763,485 |

| Sep ’22 | £154,050,057 |

| Oct ’22 | £160,257,618 |

| Nov ’22 | £195,894,531 |

| Dec ’22 | £90,173,081 |

| Jan ’23 | £201,229,875 |

| Feb ’23 | £126,041,388 |

| Mar ’23 | £227,707,143 |

| Total: | £1,933,198,928 |

The real event betting GGY in the UK for the financial year 2022-2023 was estimated to be £1.9 billion, which indicated a 13.7% decline compared to the results recorded in financial 2021-2022.

| Betting (Real Event) GGY Financial Year 2021-2022 | |

|---|---|

| Month | Betting (Real event) |

| Apr ’21 | £264,522,364 |

| May ’21 | £237,858,258 |

| Jun ’21 | £237,267,221 |

| Jul ’21 | £195,870,777 |

| Aug ’21 | £138,972,236 |

| Sep ’21 | £210,554,733 |

| Oct ’21 | £94,197,386 |

| Nov ’21 | £224,459,234 |

| Dec ’21 | £141,985,160 |

| Jan ’22 | £212,473,664 |

| Feb ’22 | £176,200,047 |

| Mar ’22 | £104,557,535 |

| Total: | £2,238,918,615 |

The GGY that was generated by real event betting in the UK for the period of financial year 2021-2022 was £2.2 billion, which indicated a 11.7% decrease from £2.5 billion recorded in 2020-2021.

| Betting (Real Event) GGY Financial Year 2020-2021 | |

|---|---|

| Month | Betting (Real event) |

| Apr ’20 | £61,525,067 |

| May ’20 | £100,106,351 |

| Jun ’20 | £216,903,656 |

| Jul ’20 | £208,671,845 |

| Aug ’20 | £163,079,255 |

| Sep ’20 | £187,823,136 |

| Oct ’20 | £284,095,282 |

| Nov ’20 | £207,602,899 |

| Dec ’20 | £317,489,037 |

| Jan ’21 | £278,325,634 |

| Feb ’21 | £261,891,858 |

| Mar ’21 | £248,346,011 |

| Total: | £2,535,860,031 |

As for a comparison between March 2019 and March 2020, we discovered that there was an 89.9% increase of real event betting GGY during the last month of the financial year ended March 31, with GGY during March 2020 amounting to £159.9 million.

Unfortunately, the virtual betting handle has also been showing a decline in GGY in the last couple of years.

| Betting (Virtual) GGY Financial Year 2022-2023 | |

|---|---|

| Month | Betting (Virtual) |

| Apr ’22 | £3,807,822 |

| May ’22 | £4,234,233 |

| Jun ’22 | £3,782,600 |

| Jul ’22 | £4,142,473 |

| Aug ’22 | £4,017,502 |

| Sep ’22 | £3,937,215 |

| Oct ’22 | £3,819,028 |

| Nov ’22 | £4,157,739 |

| Dec ’22 | £3,975,023 |

| Jan ’23 | £3,974,927 |

| Feb ’23 | £3,622,639 |

| Mar ’23 | £4,423,009 |

| Total: | £47,894,210 |

When comparing data published for the financial year 2022-2023, we see that virtual betting GGY recorded a 29.1% year-over-year decline, reducing its value to £47.9 million. Despite the reduction in GGY, virtual betting showed a smaller decline in financial 2022-2023 than the drop recorded in 2021-2022.

| Betting (Virtual) GGY Financial Year 2021-2022 | |

|---|---|

| Month | Betting (Virtual) |

| Apr ’21 | £7,616,173 |

| May ’21 | £7,233,089 |

| Jun ’21 | £5,933,221 |

| Jul ’21 | £6,081,398 |

| Aug ’21 | £5,718,477 |

| Sep ’21 | £5,308,322 |

| Oct ’21 | £5,819,079 |

| Nov ’21 | £5,311,675 |

| Dec ’21 | £6,125,645 |

| Jan ’22 | £4,779,777 |

| Feb ’22 | £4,099,134 |

| Mar ’22 | £3,537,267 |

| Total: | £67,563,257 |

Official figures for the financial year 2021-2022 showed that virtual betting GGY has reached £67.6 million for that period. Compared to the GGY recorded in 2020-2021, these results showed a 32.1% year-over-year decrease.

| Betting (Virtual) GGY Financial Year 2020-2021 | |

|---|---|

| Month | Betting (Virtual) |

| Apr ’20 | £12,814,723 |

| May ’20 | £11,277,462 |

| Jun ’20 | £9,559,895 |

| Jul ’20 | £7,954,157 |

| Aug ’20 | £6,680,409 |

| Sep ’20 | £6,088,252 |

| Oct ’20 | £6,614,781 |

| Nov ’20 | £7,173,554 |

| Dec ’20 | £7,945,760 |

| Jan ’21 | £7,888,285 |

| Feb ’21 | £7,120,443 |

| Mar ’21 | £8,407,534 |

| Total: | £99,525,255 |

Despite the trend of decline in virtual betting GGY in the last two financial years, when we compare the values for March 2019 and March 2020, we noticed that virtual betting GGY experienced a 36.9% increase, reaching £9.0 million in March 2020.

| Betting (eSports) GGY Financial Year 2022-2023 | |

|---|---|

| Month | Betting (eSports) |

| Apr ’22 | £267,606 |

| May ’22 | £667,953 |

| Jun ’22 | £924,230 |

| Jul ’22 | £2,968 |

| Aug ’22 | £897,628 |

| Sep ’22 | £476,617 |

| Oct ’22 | £784,230 |

| Nov ’22 | £1,110,496 |

| Dec ’22 | £520,232 |

| Jan ’23 | £769,803 |

| Feb ’23 | £653,044 |

| Mar ’23 | £630,872 |

| Total: | £7,705,679 |

For the financial year 2022-2023, the eSports betting GGY reached £7.7 million, with November 2022 being the only month with GGY over £1 million. The value reported for the year ended March 2023 indicated a huge year-over-year decline of 43.6%.

| Betting (eSports) GGY Financial Year 2021-2022 | |

|---|---|

| Month | Betting (eSports) |

| Apr ’21 | £1,901,663 |

| May ’21 | £2,003,270 |

| Jun ’21 | £1,008,432 |

| Jul ’21 | £1,180,269 |

| Aug ’21 | £1,024,770 |

| Sep ’21 | £1,072,047 |

| Oct ’21 | £1,061,177 |

| Nov ’21 | £780,976 |

| Dec ’21 | £1,531,662 |

| Jan ’22 | £1,258,557 |

| Feb ’22 | £784,399 |

| Mar ’22 | £56,001 |

| Total: | £13,663,223 |

While the eSports handle saw several months of the financial 2021-2022 having a GGY over the £1 million mark, the GGY generated throughout that period amounted to £13.7 million, which is 47.1% lower than the eSports betting GGY reported in 2020-2021.

| Betting (eSports) GGY Financial Year 2020-2021 | |

|---|---|

| Month | Betting (eSports) |

| Apr ’20 | £3,397,168 |

| May ’20 | £4,614,341 |

| Jun ’20 | £3,473,567 |

| Jul ’20 | £2,590,828 |

| Aug ’20 | £1,826,834 |

| Sep ’20 | £1,309,860 |

| Oct ’20 | £796,034 |

| Nov ’20 | £1,413,446 |

| Dec ’20 | £1,326,559 |

| Jan ’21 | £1,687,960 |

| Feb ’21 | £1,565,032 |

| Mar ’21 | £1,838,385 |

| Total: | £25,840,014 |

Public’s Opinion on Gambling in the UK and Sports Betting Regulations Introduced by the UK Government

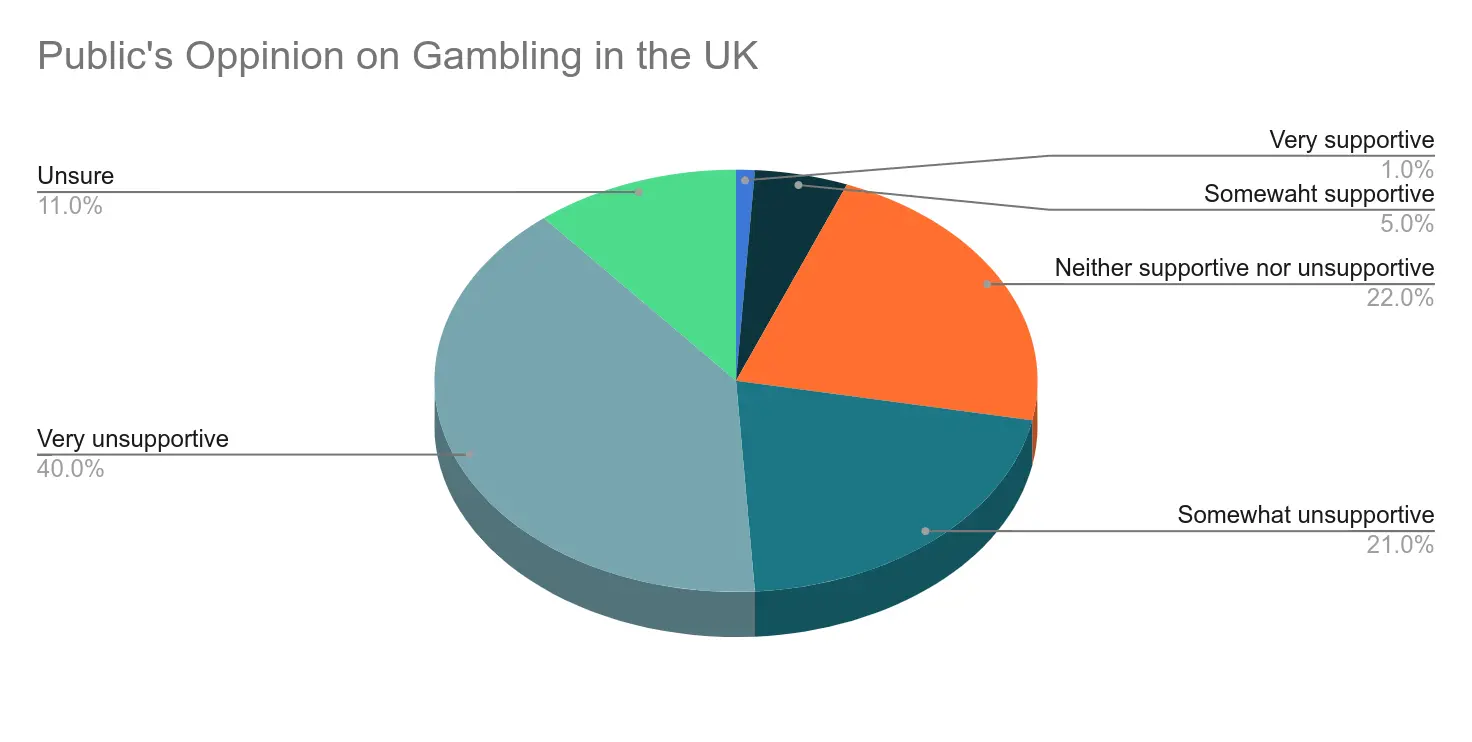

According to research, in January 2023, about 40% of people in the UK do not approve of the gambling industry in the country. This is the predominant perception among British individuals, making it very difficult for the sports betting sector in the UK to amass a bigger following of regular bettors.

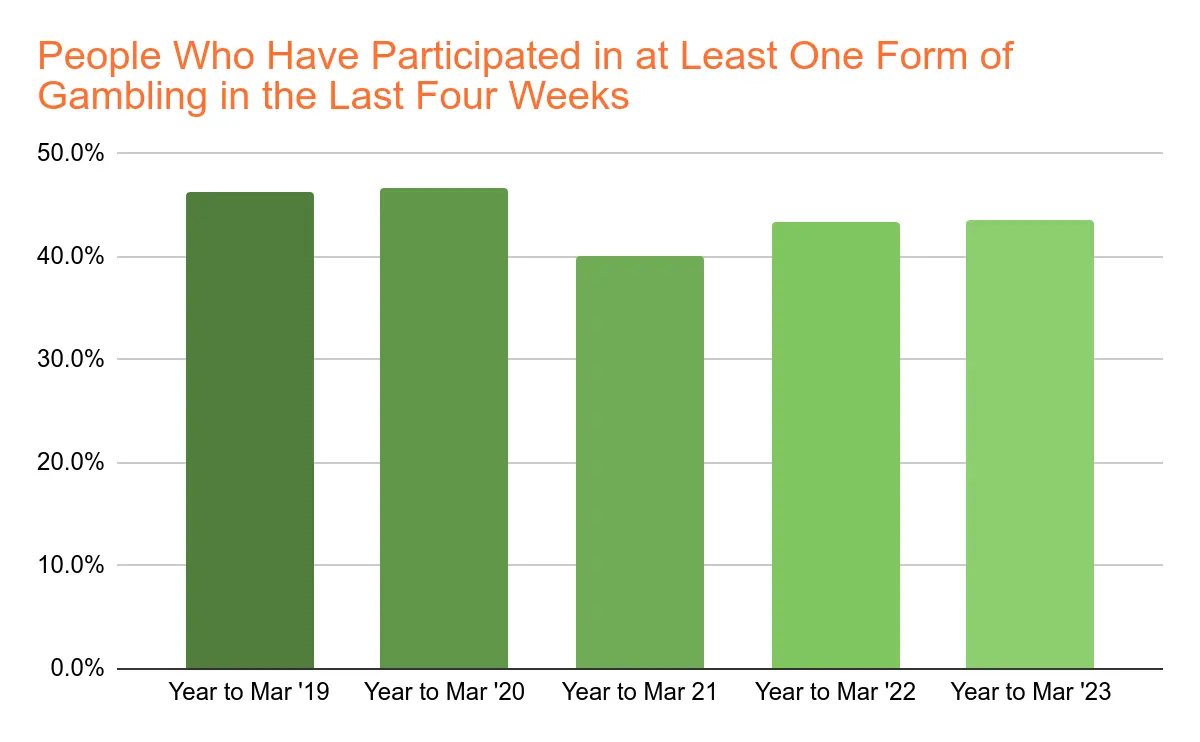

In 2019, 46.3% of respondents in a survey conducted by the UKGC reported having participated in some form of gambling in the last four weeks. By 2023, the proportion of UK gambling participants reduced to 43.5%. Despite showing a slight increase from 2022 and 2021, the number of people participating in at least one form of gambling in the previous month has declined from the number recorded in 2019 and 2020.

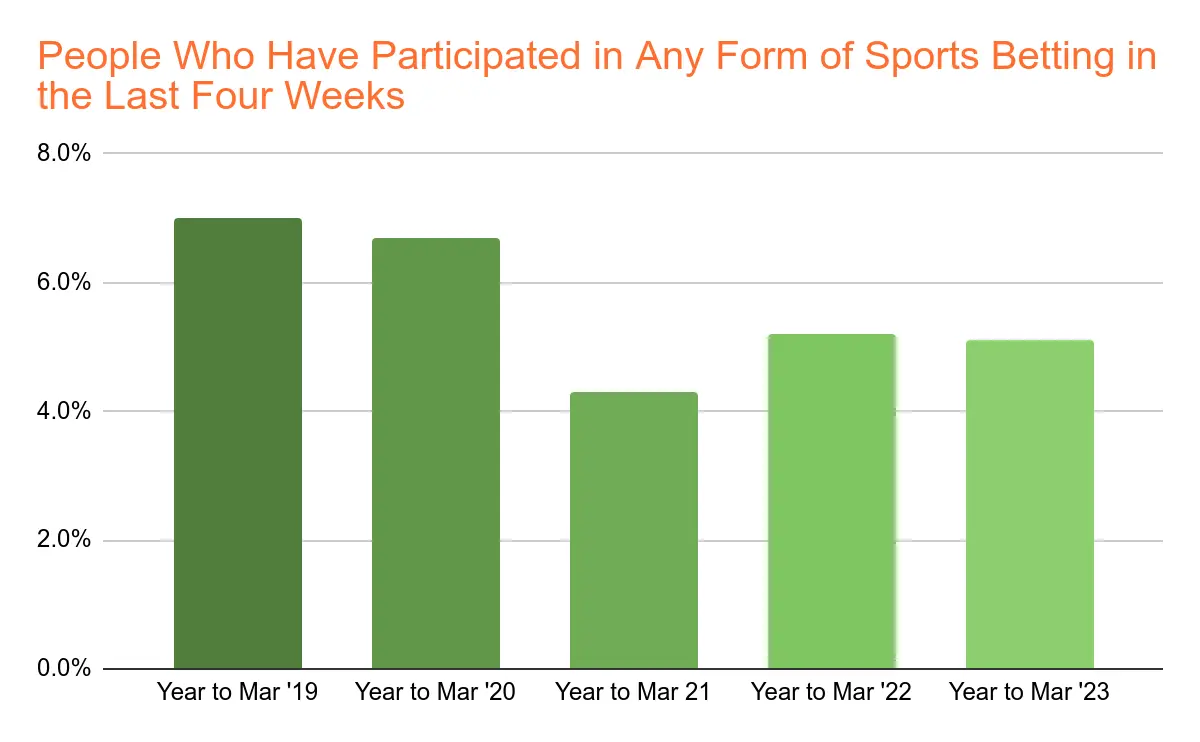

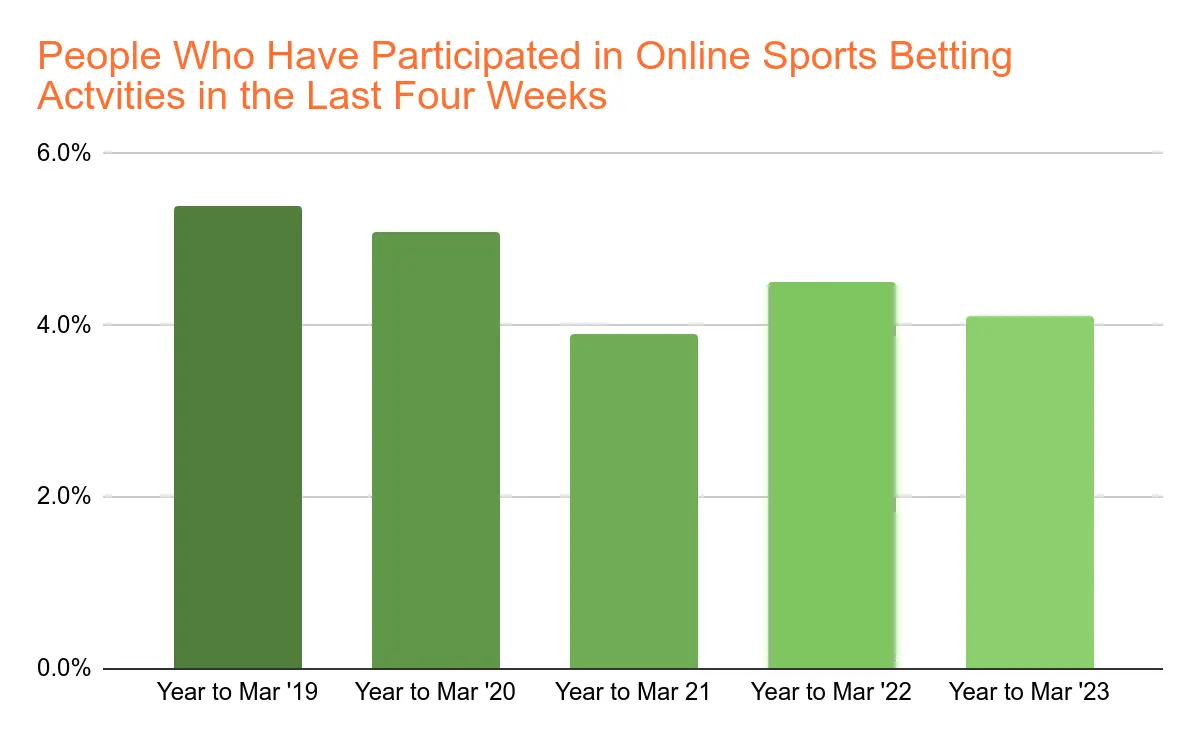

As for sports betting, the number of UK punters who have placed some type of sports bet in the last four weeks has also reduced throughout the last five years. While the number of UK bettors who have placed some form of sports bet in the previous four weeks in 2019 represented 7% of respondents, for the year ended March 2023, that number reduced to represent 5.1% of survey participants.

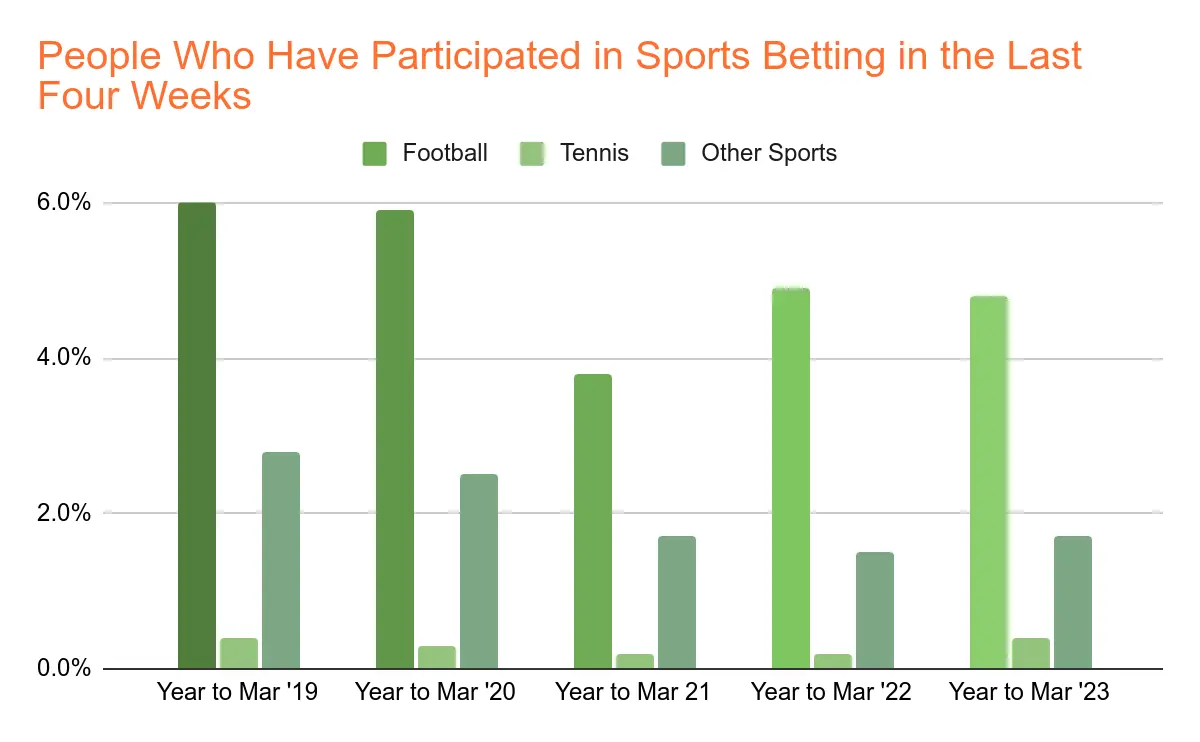

When we take a look at the figure above, we can see that all types of sports betting have experienced a decline in activity in the years after the global pandemic, with fewer bettors placing wagers on football, tennis, and other sports in 2023 than in 2019.

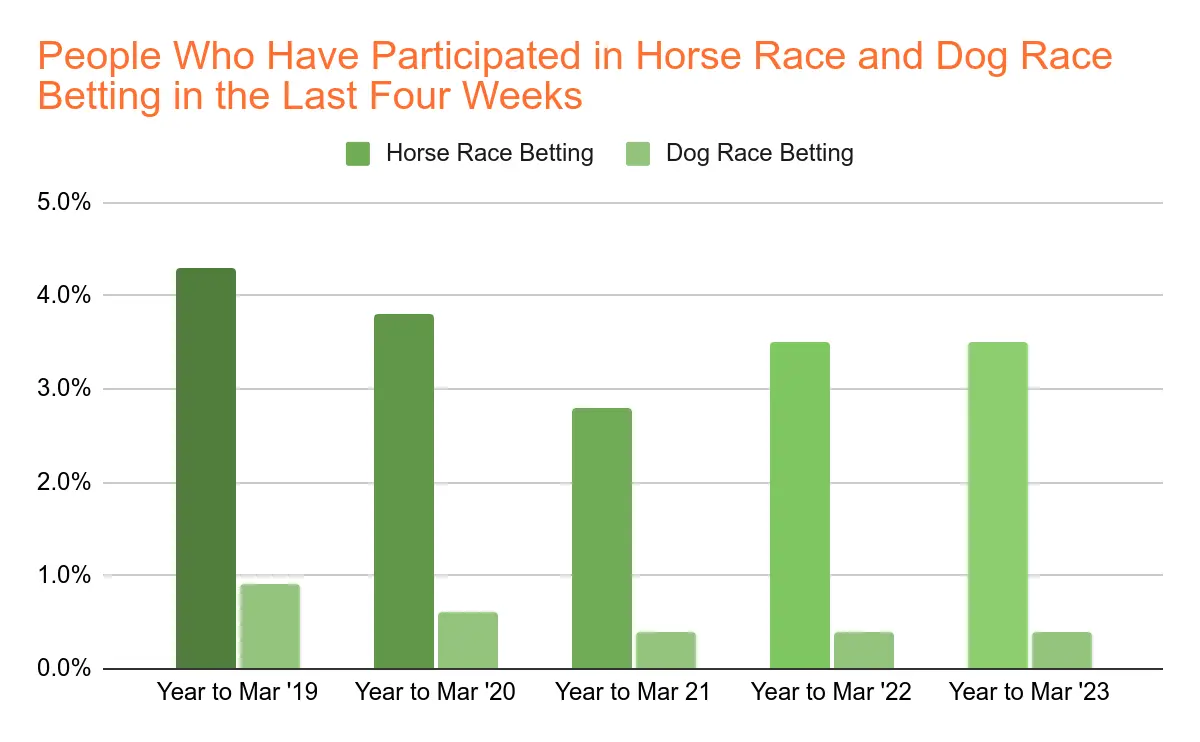

Horse race betting and dog race betting have also experienced a sensible drop in participation in the years following the global pandemic. Luckily, both handles have started to recover slowly but are yet to reach pre-pandemic levels.

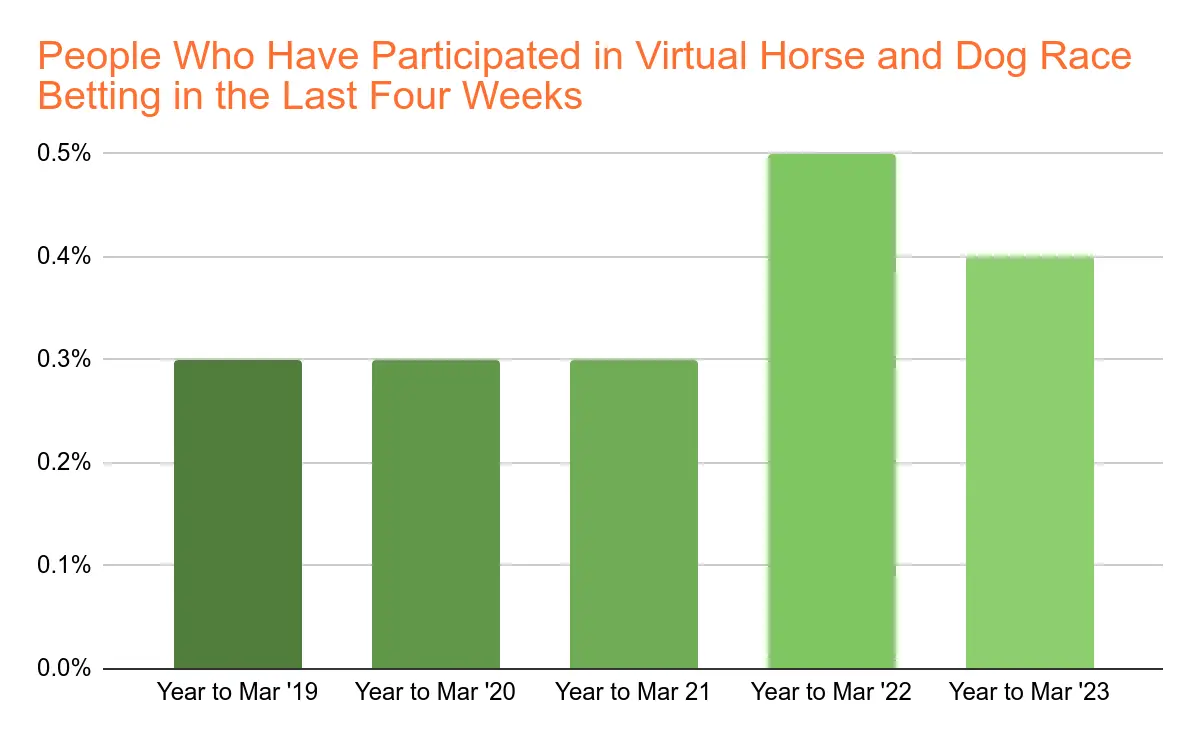

One sports betting form that has seen an increase in participation in the last few financial years is virtual horse and dog race betting. While the number of bettors placing wagers on virtual horse or dog races represented 0.3% of respondents in 2019, 2020, and 2021, the participation rate increased to 0.5% in 2022. In the year ended March 2023, there was a slight decrease to 0.4%, which was still higher than the rate in the years between 2019 and 2021.

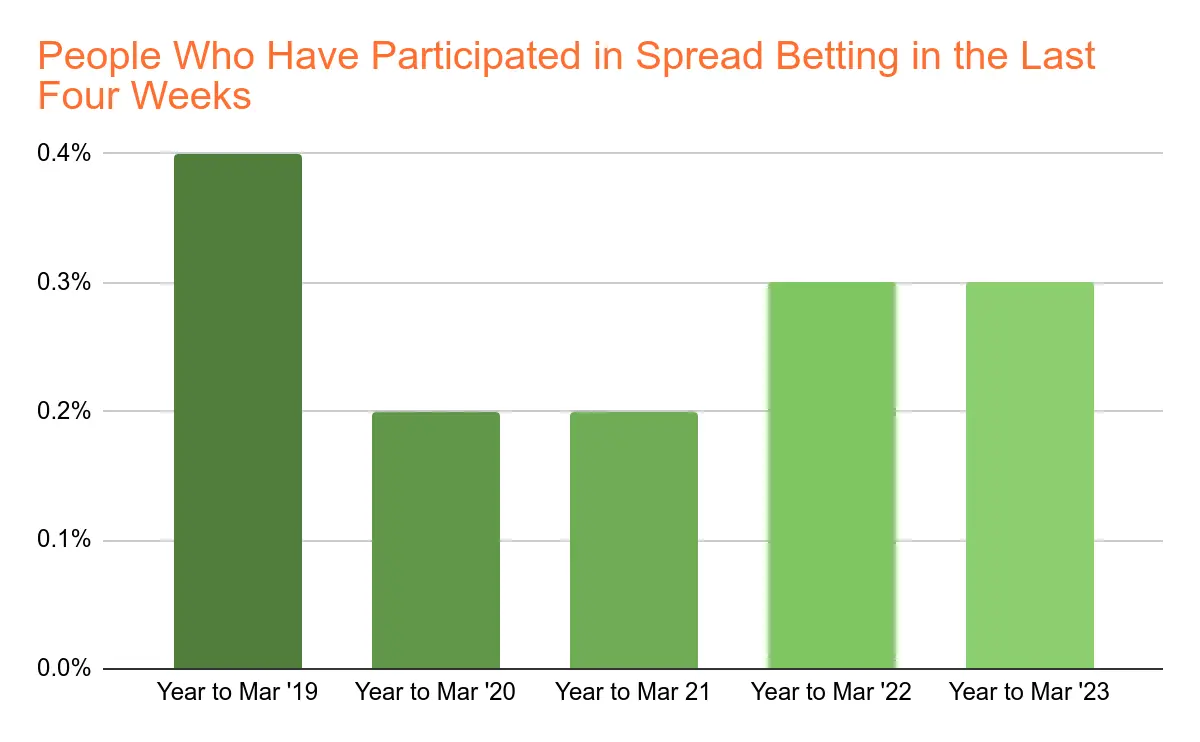

Like most forms of sports betting in the UK, spread betting has also reduced its participation rate in the years that followed the global pandemic. While there was about 0.4% of UK bettors placing spread bets in the year ended March 2019, that rate dropped to 0.2% in the years ended March 2020 and March 2021. While the spread betting participation increased slightly to 0.3% in the following two years, it is still lower than the one recorded in 2019.

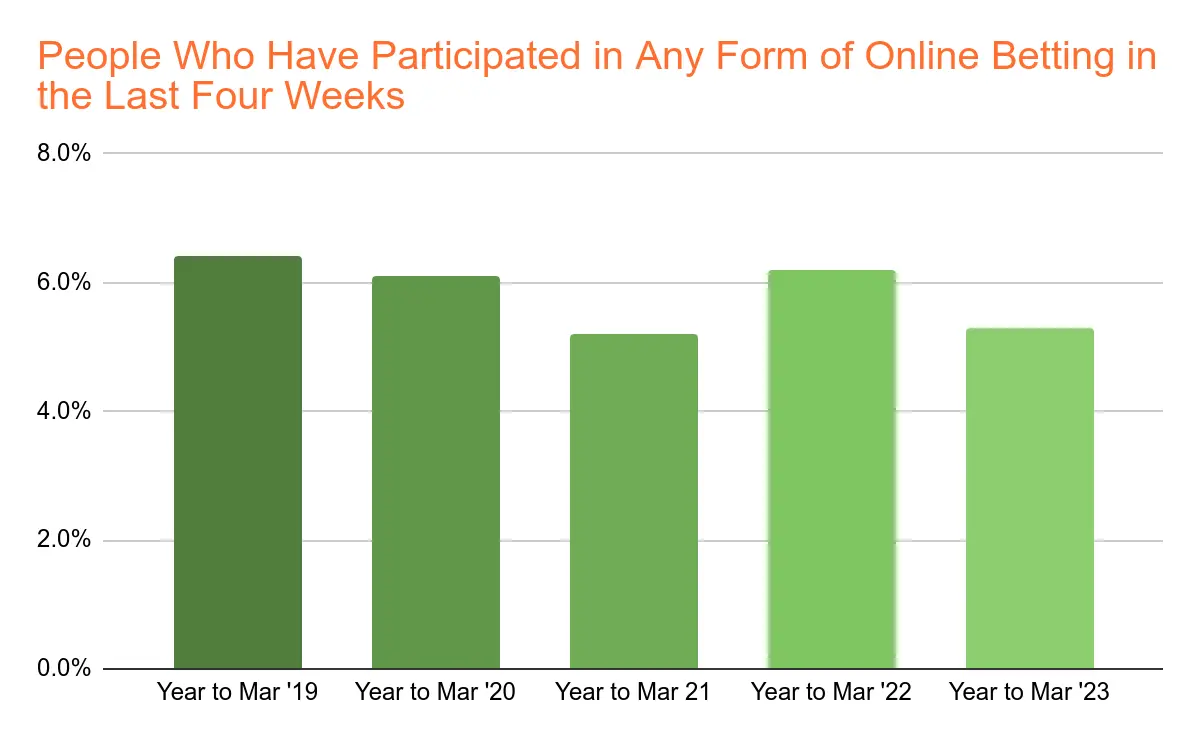

If we combine all forms of online betting in the UK, we will notice that the entire sector has suffered a decline in participation in the last few years. While 6.4% of UK bettors have participated in any form of online betting in the last four weeks during the year ended March 2019, the participation rate has started declining in the following years. In the year ended March 2022, the online betting participation rate increased to 6.2% but with the constant factors standing in the way of the sector’s growth, online betting participation declined to 5.3% in the year ended March 2023.

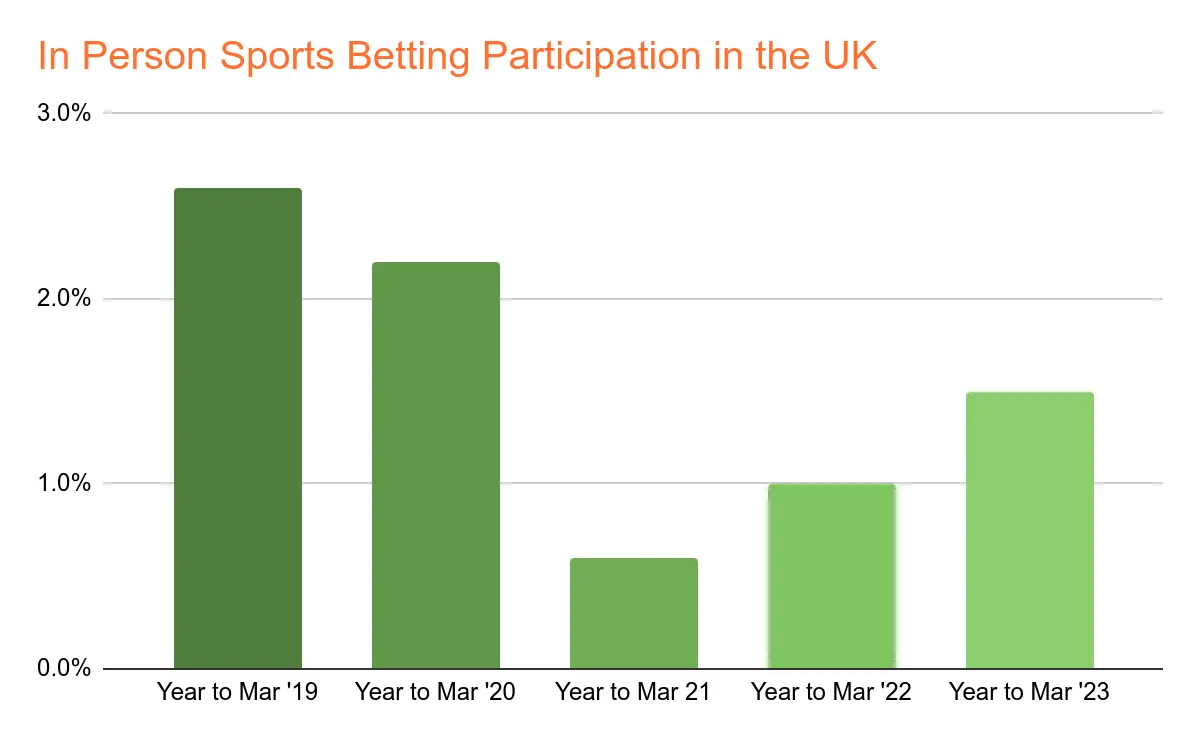

Comparison Between In Person and Online Sports Betting Participation in the UK

While online sports betting participation in the UK declined in the year ended March 2023, there was a significant improvement in the participation rate among UK punters placing sports bets in person. In the year ended March 2023, the in person sports betting participation rate in the UK was 1.5%, which showed a surge from the previous year when the participation rate was only 1%.

Projections for the Future of Sports Betting in the UK

One significant reason to question whether sports betting and overall gambling in the UK will continue to expand is the recent regulatory changes that have been introduced by the UK government in the last few years. With more people criticizing companies that try to bank on the popularity of sports betting, sportsbook brands, and even professional players, coaches, and leagues have started to change their behavior when it comes to promoting sports betting.

Of course, there are also factors that help the betting industry in the UK to continue expanding, which may lead to a continuous growth of the market’s size in upcoming years. With innovations in technology, betting platforms are becoming more accessible, giving punters the convenience of placing wagers at any time and place. While gambling-related payments via credit cards have been blocked in the UK, there have been more convenient payment solutions introduced, allowing safe and hassle-free transactions to and from sportsbook platforms.

Online betting has grown exponentially in the UK in the last few years, which is an indicator that the overall betting market in the country may continue to grow at a fast pace in upcoming years as well. The GGY of online betting in the UK expanded to £250 million at the beginning of 2022. Interactive sports betting has increased significantly during the global pandemic but the rebound in numbers of active punters betting on real sports events also showed a great jump in 2022, reaching 6.38 million in March 2022.

In 2023, sports betting remained one of the biggest drivers of total gambling revenue in the UK. The majority of bets contributing to the market growth include wagers on football, horse races, and greyhound races. Despite the drop during the global pandemic, the return of horse race betting in the UK showed a huge surge between April 2021 and March 2022, bringing the industry a total of £119.3 million.